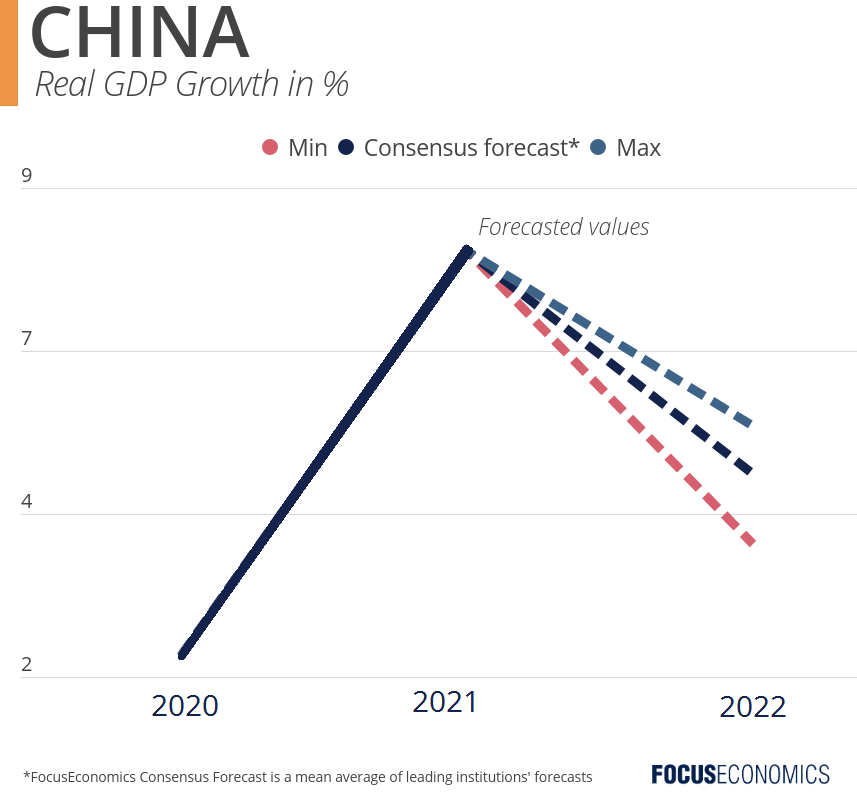

In March, retail sales fell 3.5% in annual terms—the worst reading since the height of the first wave of the pandemic in early 2020—with other indicators painting a similarly grim picture. As such, while GDP growth held up surprisingly well in Q1, our analysts see a notable slowdown from Q2, with risks tilted clearly to the downside. Over 2022 as a whole, the discrepancy among panelists’ forecasts is wide, but the Consensus is for growth to markedly undershoot the government’s 5.5% target.

Some steps have been taken to minimize the pain. Several large companies, such as Tesla, have been able to reopen factories in recent days under “closed-loop” systems, with workers eating and sleeping on site. The Central Bank has trimmed banks’ reserve requirement ratios to boost credit availability. And the government is using the familiar playbook of urging local governments to push forward with infrastructure investment. Yet these steps could have a minimal impact: Many smaller companies lack the ability to feed and house workers on site, monetary easing has so far been moderate, and the financing shortfalls faced by local governments could limit their abilities to boost spending on infrastructure.

A more durable economic turnaround would require Beijing to loosen its iron grip over the pandemic. For now, leader Xi Jinping appears determined to stay the course and maintain the country’s zero-tolerance approach. Partly as a result, the yuan has tanked since mid-April as foreign investors took flight. A similar exodus among expats—which was already underway before the latest lockdowns—is accelerating according to media reports. This loss of foreign talent is a risk not only to short-term activity, but also to the country’s longer-term economic prospects, given the still-large productivity gap between China and the West.

Without a course correction by the government, the only way is down for Chinese GDP forecasts in the months ahead. The rest of the world should take note: Chinese supply disruptions are likely to filter through to higher global inflation in the coming months, while soft Chinese demand could also weigh on other countries’ external sectors. The conclusion of all this is clear: The international economic panorama is only going to get tougher.

Insights from Our Analyst Network

On the GDP outlook, analysts at Nomura commented:

“With the ongoing lockdowns, we have slashed our China Q2 GDP growth forecast to 1.8% y-o-y from 3.4%, which would represent a marked downturn from 4.8% in Q1. We think global markets are underestimating the consequences of China’s ZCS, as attention remains focused on the Russia-Ukraine conflict and Fed rate hikes.”

On the potential for further stimulus, Ho Woei Chen, economist at United Overseas Bank, said:

“We maintain our 2022 GDP growth forecast for China at 4.9%. The strength of an economic rebound in the second half of the year will depend on how soon China can bring the COVID-19 under control and ease its draconian COVID-19 measures. As the current outlook is far below the official growth target of “around 5.5%” for 2022, there is likely further room for policy support including cuts to the interest rate and easing of its real estate measures to boost confidence.”