Close to peak:

In October, the International Energy Agency (IEA) released a report in which it predicted that demand for oil, natural gas and coal would peak by 2030. Thereafter, coal demand is expected to go into a steep decline, while gas and oil demand will hover close to their 2030 level for the subsequent two decades. Lower demand in advanced economies and China amid the shift to renewables are set to be behind this transformative shift in global energy patterns, more than offsetting higher demand from emerging markets excluding China.

The outlook for prices:

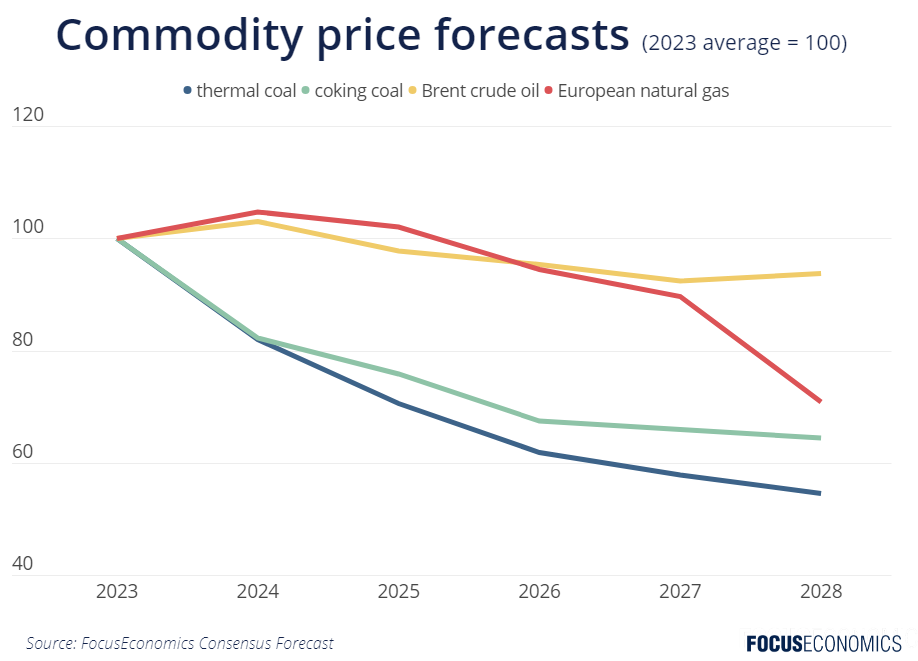

The Consensus among our panelists is for coal prices to fall sharply over our forecast horizon to 2028 as the shift away from this dirtiest of energy sources accelerates. Among the three key fossil fuels, demand for coal will be the first to peak, as soon as the mid-2020s. European natural gas prices are also projected to fall—albeit less sharply—as gas power generation demand ebbs and homes and business increasingly adopt alternatives to gas heating. Meanwhile, oil prices are seen staying the closest to their current levels, supported by supply discipline by the OPEC oil cartel and a continuing rise in oil demand for petrochemicals, aviation and shipping. These three industries are yet to undergo a green revolution, unlike the shift to electric power currently underway in the road transport sector.

Uncertainty ahead:

The pace of the shift away from fossil fuels—and consequently the speed and scale of the decline in coal, gas and oil prices—is still hard to predict. On one hand, technological innovations in renewable energies could spur a faster green transition than expected. On the other, low auction prices could prevent private firms from bidding for renewable energy contracts, and governments could backtrack on environmental commitments for political reasons, such as recently observed in the UK. A Republican president in the White House from 2025 could stymie the climate transition in the U.S. And the pace of the structural economic growth slowdown underway in China is a key risk given that China accounted for more than 50% of global energy demand growth over the past decade. Regardless of the pace of the shift however, one thing seems clear: In the long term, the only way is down for fossil fuel prices.

Insight from our analysts

On oil demand, EIU analysts said:

“From 2025 demand growth will tail off more significantly as longer-term trends return to the fore. We expect oil consumption in OECD countries to start declining, given those countries’ focus on energy efficiency and measures to tackle climate change. Similar trends are at play in the rest of the world, but given their stage of development and strong economic growth, oil demand will continue to expand at a modest pace for at least a few more years. We expect developed economies to fall short of the financial pledges that they have made at previous UN climate conferences, which will further delay the green transition in the developing world.”

Goldman Sachs analysts said:

“Technological innovations and new financing methods are making renewable energy more accessible than ever before. As a result, solar, wind, hydropower and other sustainable sources are expected to account for half of our global energy mix by 2030.”

Our latest analysis

- The war with Hamas is set to rock Israel’s economy. Get more details here.

- Russia’s Central Bank hiked rates in October. Read more here.

Get much more detail on the economic outlook for 2024 in our latest special report, in which we polled our panelists on the key events to watch next year. The report examines:

- The future of U.S.-China ties

- Whether the Russia-Ukraine war will end next year

- The likely outcome of the U.S. elections

- The main risks to the economic outlook next year

- Our regional, country and commodity forecasts