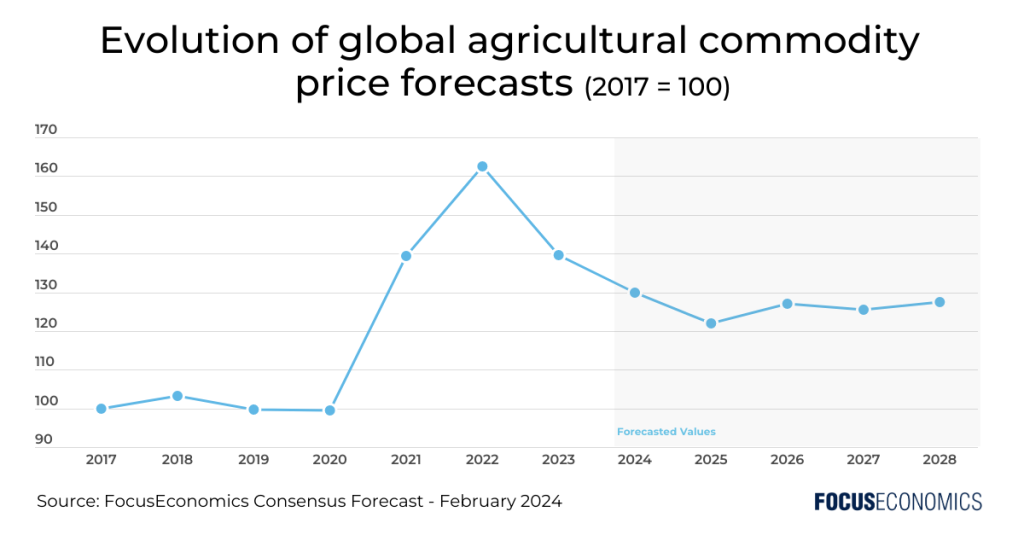

The ongoing El Niño weather pattern is set to restrain agricultural output in 2024, as it did last year, despite being less strong than initially feared. In addition, La Niña—the “inverse” of El Niño—has a 55% likelihood of developing in June–August, according to the U.S. weather service, further dampening primary sector production. This insight piece explores the evolution of commodity price forecasts given changing weather conditions.

The El Niño weather pattern drove up commodity prices in 2023:

Last year, the price of “soft” agricultural commodities—coffee, cocoa, sugar, corn, soybeans and more—rose 12.3% from the prior year, according to the Dow Jones-UBS index. This led global inflation to decrease less sharply last year, after spiking in 2022 due to disruption to commodity supply amid Russia’s invasion of Ukraine. In turn, this has slowed central banks’ moves to lower interest rates.

In Latin America, Brazil’s primary sector has been particularly badly affected by extreme weather. In Asia, 2023’s monsoon was the driest in five years in India, dampening the output of key crops such as rice and leading to the imposition of several export restrictions. In Africa, the Ivory Coast saw an over 35% year-on-year fall in delivery of cocoa to the nation’s ports in October–January.

2024 commodity price forecasts to remain elevated ahead:

There is a 79% probability that the El Niño weather pattern will end by April–June, according to the U.S. weather service, suggesting that the world economy has weathered the worst of the climate phenomenon already. That said, the economic impact of El Niño will likely be seen even after its end as crops are harvested; over the last six months, our panelists have raised their Q4 2024 commodity price forecasts for sugar, cocoa, coffee, palm oil and rice.

La Niña is sometimes known as the “anti-El Niño” and occurs when trade winds strengthen and push warm water toward Asia and cold water toward the west coast of the Americas. If there is a strong La Niña later this year, the output of wheat and corn in the U.S., as well as soybean and corn output in Latin America, are likely to be affected. That said, a moderate La Niña could slightly boost agricultural output and lower 2024 commodity price forecasts.

Insight from our panelists:

On the outlook for coffee and cocoa prices, analysts at the EIU said:

“Prices for food, feedstuffs and beverages (FFB) will rise over the course of 2024, driven primarily by beverages, as El Niño will hit production and therefore prices for coffee and cocoa will increase. Some relief is in sight, with the US National Oceanic and Atmospheric Administration (NOAA) giving a 72% chance that El Niño will come to an end by mid-year. But the damage to this season’s harvests will already be done by then, with coffee and cocoa production forecast to fall by 9% and 13% respectively in the 2023/24 crop season.”

Analysts at Fitch Solutions commented on India’s export restrictions:

“In September 2022, India introduced a ban on broken rice exports, which was then followed by the July 2023 introduction of a ban on non-basmati white rice exports and the August 2023 introduction of a 20% duty on parboiled rice exports and introduction of a minimum price for basmati rice exports. As a result, India, which is the largest world exporter by a considerable margin […] saw 80-90% of its rice exports subject to export restrictions with 40-50% subject to an outright export ban […]. Concerns as to export flows have also been compounded by the current El Niño, which is associated with below-average rainfall across much of Southeast Asia as well as reduced monsoon rainfall in India.”

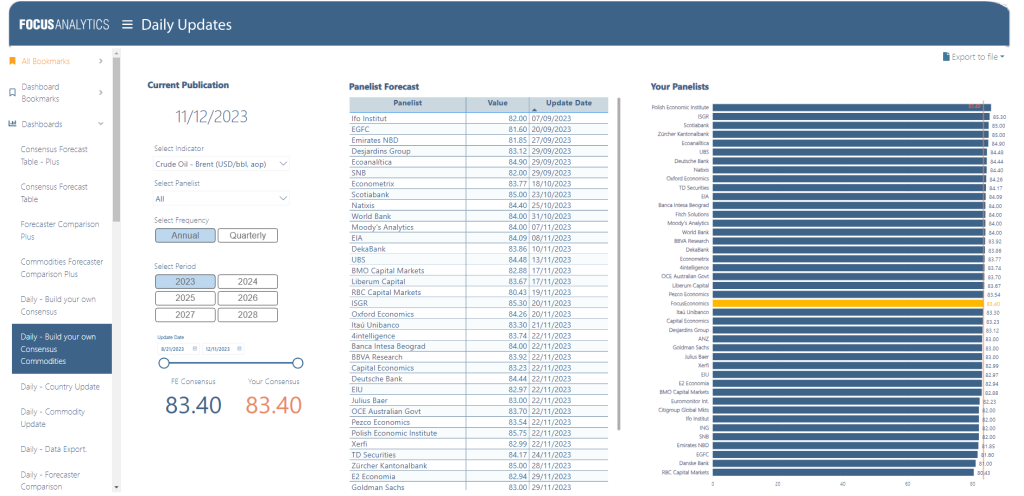

The latest economic projections at your fingertips with daily forecast updates

To explore this exciting new feature, we would be happy to offer you a demo or free trial.