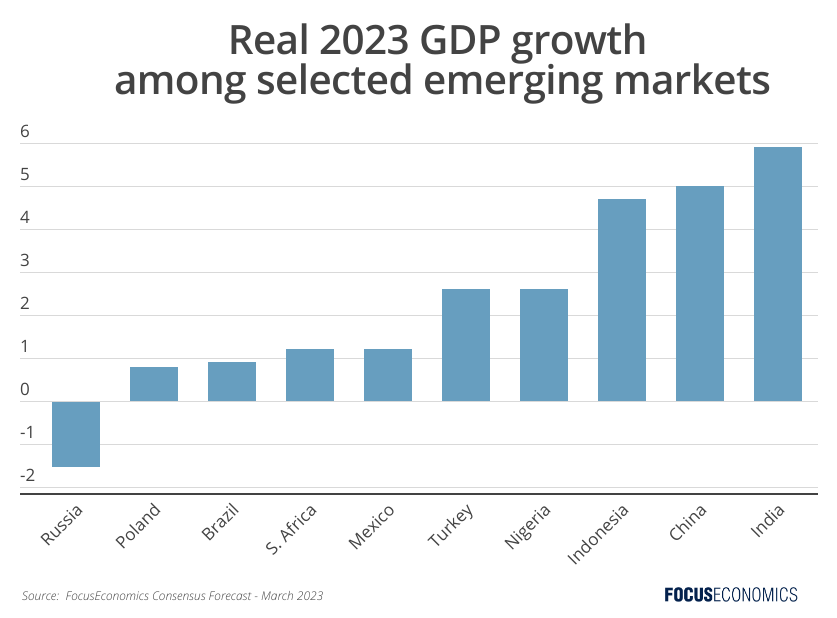

Go EastAs has been the case in recent decades, our Consensus is for Asian economies to record by far the fastest growth among emerging markets this year. Favorable demographics, relative institutional stability, high savings rates and openness to global trade can all help explain Asian exceptionalism. Among the region’s economies, Bangladesh, India and Vietnam are expected to be the top performers, while China should expand by around 5% thanks to the removal of Covid-19 restrictions. Africa RisingSub-Saharan Africa (SSA) is likely to be the second-fastest-growing world region. And when excluding the sluggish economies of South Africa and Nigeria, growth would be over 4%, comparable to the rate in Asia. SSA’s fast-growing population, high demand for its commodities—many of which are essential to the green transition—and gradual improvements in governance all support the outlook. However, the reliance on the primary sector leaves the continent at the mercy of commodity price fluctuations and extreme weather events.  Middle of the RoadThe Consensus among our panelists is for the Middle East and North Africa to record roughly 3% growth this year, a slowdown from last year as the region’s oil output stagnates and oil prices pull back. That said, economic reforms aimed at diversifying away from oil will support growth among energy exporters, with the UAE the undisputed leader on the reform front. Recent improvements in intra-regional relations also bode well, although Israel’s new right-wing government risks undoing part of the country’s rapprochement with Arab states. Latin America LaggingLatin America is forecast to grow by a paltry 1.0% this year, according to our panelists. The region’s central banks have been the world’s most aggressive over the last 18 months, with interest rates now well in double digits in many countries. In addition, investment will be hit by sociopolitical uncertainty—be it in the form of unrest in Peru following the arrest of former President Castillo, the lack of clarity over Chile’s new constitution, or investor concerns over fiscal policy in Brazil under Lula. Battle ScarsEastern Europe will be the worst-performing emerging market region, largely due to expected contractions in Russia and Belarus as Western sanctions tighten. Other Eastern European economies will suffer from damaged trade ties with Russia, high inflation and tighter monetary policy. |

Insights from Our Analyst NetworkOn Africa, the African Development Bank said: On China, Goldman Sachs analysts said: |