Click on image to view larger version

Daniel Solomon joined Euromonitor International in 2011 and is responsible for macro-economic modelling and analysis. His areas of expertise include business cycles, financial markets and the macroeconomy, dynamic general equilibrium models and applied macro econometrics. Daniel holds a Master of Science in Management/Finance from Queen’s University – Queen’s School of Business, Canada, a Master of Arts in Economics from McGill University, Canada and a Ph.D. in Economics from the Université de Montréal, Canada.

Euromonitor International is the world’s leading independent provider of strategic market research. With 15 offices around the world and in-country analysts in over 100 countries, Euromonitor International provides statistics, analysis and reports, as well as breaking news on industries, economies and consumers worldwide. We connect market research to your company goals and annual planning by analysing market context, competitor insight and future trends impacting businesses worldwide.

In March, the U.S. announced 25% tariffs on steel imports and 10% tariffs on aluminium imports from countries including China. In response, China retaliated in April with 15-25% import tariffs on 128 U.S. products ranging from aluminium waste and scrap, to pork, fruits and nuts, and others. Following his original tariff roll out, President Trump signed a memorandum on imposing additional import tariffs on 1,300 Chinese goods, with a focus on high-tech items. China responded with a tariff hike on a similar value of U.S. goods’ imports, including soybeans, aircraft, and autos.

Impact on economies and consumers

The recent U.S. tariffs on Chinese imports are focused on B2B goods, and the list seems to have been chosen with a concern for reducing the impact on consumers that could affect upcoming congressional elections results. However, the tariffs would still raise prices for consumers indirectly, due to firms passing on higher production costs into final prices. From the Chinese side, the new tariffs on U.S. imports affect a diverse set of industries such as soybeans, vehicles, chemicals and aircraft. In response to the Chinese tariffs, U.S. President Trump threatened he may also raise tariffs on another USD100 billion in Chinese imports.

The current tariffs stand at USD12.5 billion (on USD50 billion in imports from both sides), representing less than 0.1% of Chinese or U.S. GDP. The specific tariffs announced so far have quite a small macro impact on either China or the US, on the order of 0-0.2 percentage points lower GDP levels.

Unofficial sources suggest the U.S. and China started trade talks soon after the April announcement. However, talks apparently broke down after the U.S. insisted China significantly reduce its support for domestic high-tech industries. This came after Chinese negotiators offered to take measures to reduce the trade deficit by USD50 billion by encouraging more U.S. imports, in addition to a speech by Chinese President Xi promising to reduce import tariffs on cars and other products.

Is this the beginning of a trade war?

An all-out trade war is unlikely because China can attain most of its goals in fighting against tariffs by hitting specific U.S. multinationals that have a big presence in China, or strong reliance on Chinese suppliers. These large multinationals have powerful lobbies that could pressure the U.S. government to relax tariffs under threat of retaliatory actions from the Chinese government. In this scenario, several large U.S. companies could be severely hurt but with a small impact on the overall U.S. economy. Furthermore, there may be political gains to China acting more moderately than the US. This would improve its image as a more globalist, pro-free trade, world power that could eventually take over the global leadership role from the US.

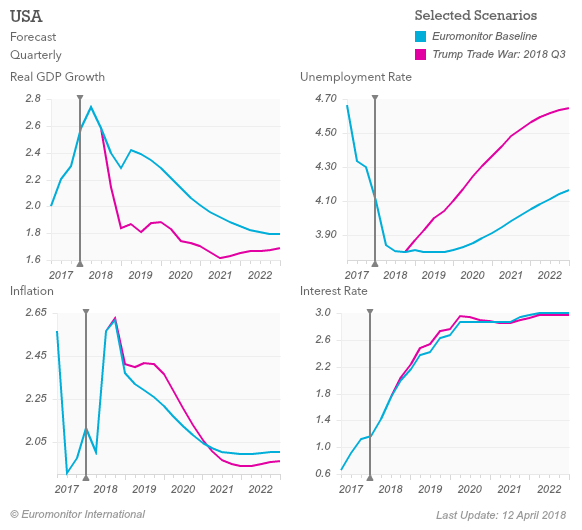

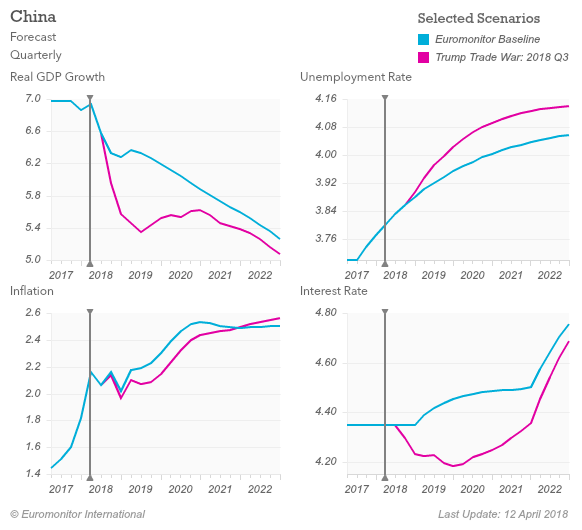

However, trade war risks have still significantly increased since the beginning of 2018. In our Trump Trade War scenario, bilateral tariffs between the U.S. and China increase by 15-25 percentage points. In this scenario, over a 3-year horizon, U.S. real GDP declines by 1-1.5%, while China’s GDP declines by 1.5-2% relative to the baseline forecast. We assign this trade war scenario a 10-20% probability over the next 12 months, and a 15-35% probability over the next two years.

Impact of Trump Trade War on Key Macro Indicators in U.S. and China: 2017-2022

For further enquiries, please contact:

Daniel Solomon, PhD Economist at Euromonitor International, at Daniel.Solomon@Euromonitor.com

Sample Report

5-year economic forecasts on 30+ economic indicators for 127 countries & 33 commodities.