History of iron ore

You may recognize iron ore as one of the key commodities traded across the world, but our history with iron ore predates all modern financial markets by a good few years. As far back as 3200 BC humans have been working with iron in various capacities. However, it wasn’t until around 1200 BC in ancient Mesopotamia that iron production became widespread.

Bronze was the dominant material of choice when it came to producing weapons, armor, tools, and building materials before this time. Bronze is actually a metal alloy, meaning it is forged from two different metals; copper and tin. Unfortunately, copper and tin are seldom found near each other and therefore gathering enough of both metals to make bronze was quite an onerous task. Some historians have stated that the Bronze Age came to an end because of a shortage of tin around 1300 BC amid trade disruptions, which forced metalworkers to find an alternative. Whatever the reason, the beginning of large-scale production of iron brought the Bronze Age to an end and thus brought iron ore into prominance.

The beauty of iron is that it is just one metal. It is not an alloy and therefore, producing iron was rather easy in comparison especially with the development of iron ore smelting to remove impurities, which was a game changer for iron production. Thus, iron production took off and was associated with the expansions of many great civilizations over the millennia. It was used extensively throughout the roman empire, during the Middle Ages, all the way up to the Industrial Revolution.

Iron ore’s perhaps most important contribution came during the Industrial Revolution in the 1800s when iron began to be used to produce steel on a mass scale. The Economist has referred to iron ore as the most important commodity after oil and stated that the development of processes to turn raw earth into steel one of “mankind’s most ingenious achievements.”

Although steel had been produced going back hundreds of years, it did not become a major commodity until the 1800s, especially with the invention of the Bessemer process which was an innovation that allowed for the mass production of steel. Later Andrew Carnegie, the famous Scottish steel tycoon and founder of what is today U.S. Steel, complemented the Bessemer process with the use of the open-hearth furnace to produce steel in the late 19th Century. Iron is still primarily used to this day to produce steel. In fact, it is estimated that 98% of iron ore extracted today is destined for steel production.

Iron ore’s more recent past as a commodity is a rather tumultuous one. Iron ore played a key role in the lead up to WWI as the iron and steel industry was very important to Alsace-Lorraine, territory that was disputed between Germany and France in the early 20th century. However, as the world became more globalized, locally sourced materials for steel making were no longer needed. The rise of cheap bulk shipping, with ships ironically made of steel, allowed the steel industry to break free as iron ore and coal were able to be shipped from far off lands.

After World War II, Japan’s reconstruction called for massive iron ore imports from, of course, Australia, which is still the world’s biggest exporter of iron ore. Japan’s government went on to sign contracts of upwards of 10 years to guarantee that Australia could continually secure mining investment and provide iron ore for them. However, with the arrival of iron ore from Brazil into the market place, a one-year benchmark price system was put into place that lasted for 40 years.

Although that sounds amazing considering how often commodities prices change on today’s markets, the system worked until fairly recently because global steel production grew very slowly and iron ore prices didn’t change much. It wasn’t until early last decade that the price of iron ore began to take off as China’s rapid economic rise led to the country becoming the biggest importer of iron ore, overtaking Japan. As demand grew prices skyrocketed with supply unable to meet demand after decades of little investment.

The antiquated benchmark system that was hammered out between Japan and the big three steel makers, Rio Tinto, BHP Billiton and Vale, outlived its usefulness as China elbowed in, demanding to play a part. Unfortunately for China, their biggest steel maker, Baosteel, only owned 6% of the global market and therefore did not have the bargaining power necessary to influence negotiations. Eventually, however, the big three decided in 2010 to abandon the benchmark and move to short-term contracts at prices set on a spot market.

After skyrocketing last decade, iron ore prices have come back down to Earth in recent years as the commodities super cycle, driven largely by the rapid expansion of China, came to a close. In addition to steel prices, the health of China’s economy is strongly linked to iron ore prices. As China’s economy has slowed in recent years, so has demand for iron ore and prices have consequently fallen. Iron ore prices averaged over USD 130 per metric ton in 2013. Last year they averaged just over USD 58 per metric ton.

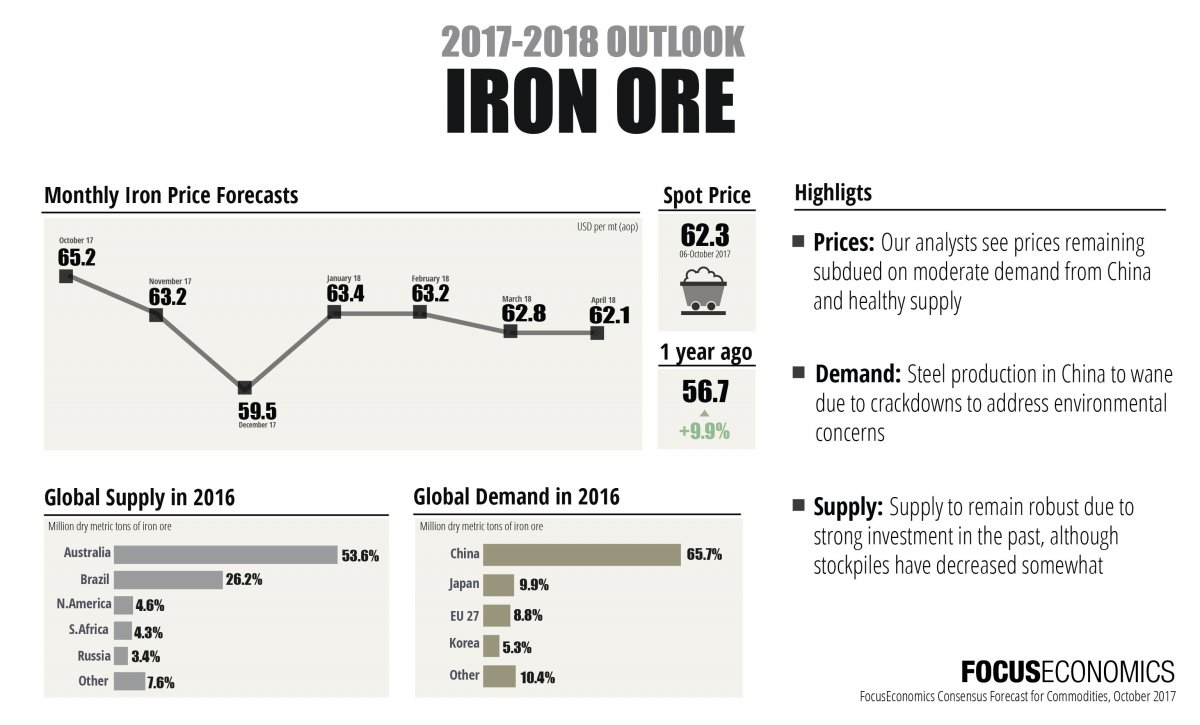

Click on image to view larger version

Iron ore prices have plummeted this year. October’s price was 22.6% lower on a year-to-date basis. Behind the recent plunge in prices is a subdued outlook for demand amid a healthy supply of iron ore. In China, environmental concerns have led to a crackdown on steel producers, which will cause steel production to wane and is reducing demand for iron ore. In addition, tighter credit conditions in China or a slowdown in China’s economy could further weigh on steel production. On the supply side, although stockpiles of iron ore have decreased—inventories at Chinese ports dropped for the seventh consecutive week in mid-September—supply going forward is expected to remain robust due to strong investment in the past.

What is Iron Ore?

Iron ore is a mineral from which metallic iron can be extracted when heated in the presence of a reducing agent, such as coke. Iron ore deposits are found in sedimentary rocks, which are essentially rocks that have been formed over time from the accumulation of different sediments. The two most important minerals extracted from iron ore are iron oxides hematite and magnetite. These two iron oxides are used to produce just about every iron and steel object you can image.

How does Iron Ore form?

According to Geology.com almost all of our planet’s major deposits of iron ore are found in rocks that formed around two billion years ago. Back then, copious amounts of dissolved iron could be found in the ocean with almost no dissolved oxygen. It wasn’t until the first organisms capable of photosynthesis came into existence that iron ore began forming deposits. As these organisms released oxygen into the waters, it combined with the dissolved iron, which produced hematite and magnetite. These minerals then accumulated on the sea floor and are now known as the banded iron formations.

As the name suggests, banded iron formations, or BIF for short, is a term used to describe a unique formation of sedimentary rock that appear as thin bands. The different colors contrast against each other and can appear similar to a rainbow.

Banded Iron Formations in Soudan, Minnesota, U.S.

What is iron ore used for?

The vast majority of iron ore is used to produce iron which is in turn used to produce steel. 98% of the iron ore mined today is used for steel production. This includes staples, cars, and steel beams used in the construction of buildings and just about anything else where iron and steel are needed.

How is iron ore mined and processed?

Iron ore is generally located near the Earth’s surface and is therefore mined usually in large open pit mines using a blast and removal technique. The surface soil and rock, also known as the overburden, is dug away to get to the iron ore. This rock is blasted using explosives and the remnants are put into large dump trucks that can hold hundreds of tons. These trucks haul the rock out of the open-pit mine where the ore is usually loaded onto trains. The rock is then taken by rail to processing plants to produce iron and ultimately, steel.

How is iron extracted from iron ore?

To separate the iron ore from the rock, it is ground down and separated by powerful magnets. The ore is then formed and heated into marble sized pellets. Coking coal is used to heat the furnaces which will help in converting the iron ore into iron. The coal is crushed and sealed in air tight ovens and baked for 12 to 16 hours. This yields solid carbon fuel which will come together with the iron ore pellets in a blast furnace. A bit of limestone is added to remove any impurities. Super-heated air pumped into the blast furnace combusts to the coke and turns the ore into molten iron reaching degrees upwards of 2700 degrees Fahrenheit (1480 degrees Celsius). The molten hot iron is then put into massive submarine ladles and taken to the steel mill to produce cold hard steel. Sometimes it is cast into iron ingots, also known as pig iron, for later use or resale.

How much iron ore is produced per year?

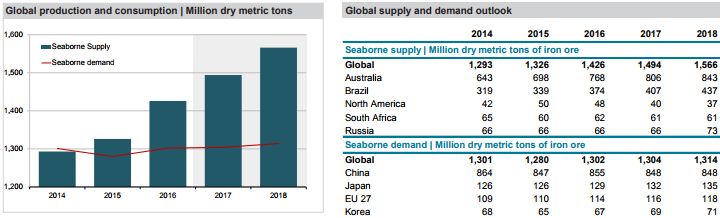

According to the USGS, about 2230 tons of useable iron ore was produced globally in 2016. Australia, Brazil and China are responsible for the bulk of the iron ore produced per year, accounting for roughly 70% in 2016, while Australia accounted for 37% itself. Seaborne iron ore is iron ore that is produced to be shipped to other countries. Below is a graph and table showing historical data and forecasts on seaborne iron ore supply and demand from our Consensus Forecast report.

What countries have the highest iron ore reserves or deposits?

Iron ore reserves are defined as deposits of iron ore that can economically and feasibly be extracted. However, these numbers are often dynamic, meaning that the numbers may change as ore is mined or the feasibility of extraction is diminished. More commonly, however, the numbers may increase as additional deposits are developed, current deposits are more thoroughly explored, or new technology makes previously unfeasible extraction of ore, feasible. According to the USGS, Australia has by far and away the most in iron ore reserves followed by Russia, China and Brazil.

That’s about it for iron ore. If you have any other questions related to iron ore or would like suggest another commodity send us an email at blog@focus-economics.com. Also, don’t forget to download one of our sample reports by clicking on the button below.

Banded Iron Formation image provided courtesy of James. St. John

Sample Report

5-year economic forecasts on 30+ economic indicators for 127 countries & 33 commodities.