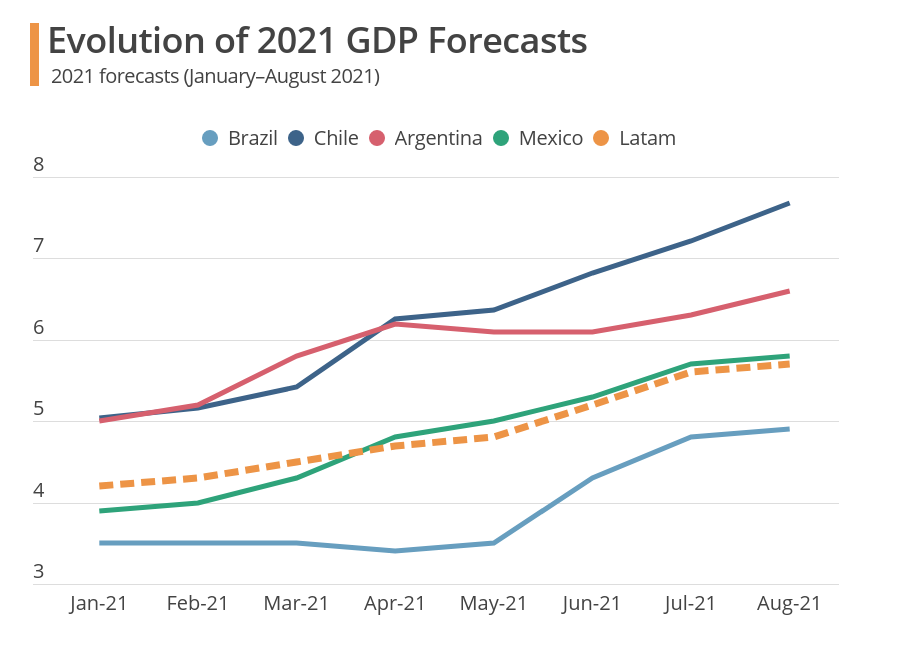

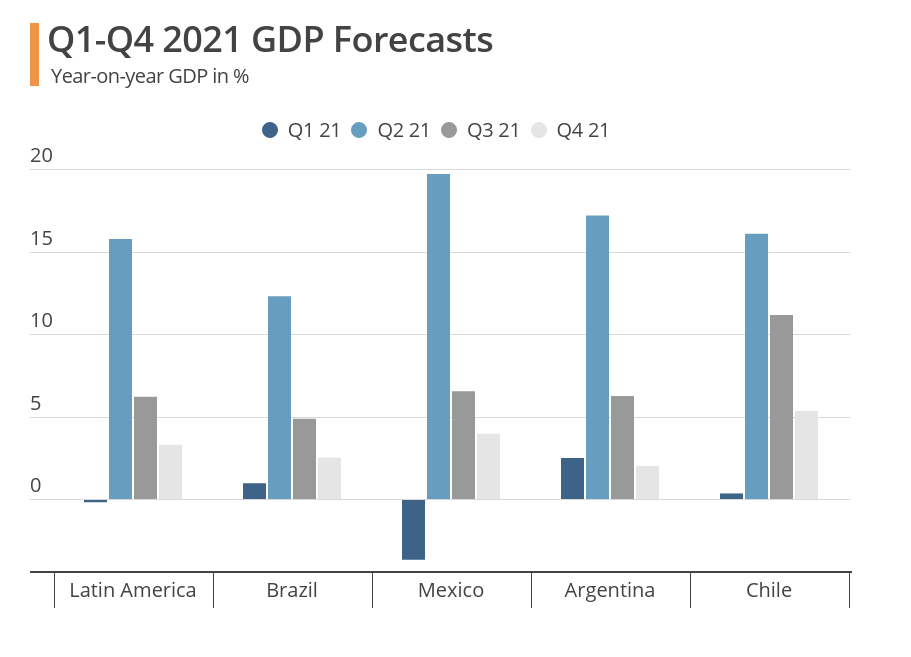

Looking ahead, our panel of analysts expects annual GDP growth to normalize in H2 this year as the low base effect fades, but it should remain upbeat nonetheless. Domestic demand should continue to improve amid pent-up spending and as looser restrictions support private consumption and fixed investment. Nevertheless, headwinds still persist due to elevated public debt, high unemployment and inflation, sociopolitical instability, the spread of the Delta variant globally and the recent hawkish turn from key central banks such as those of Brazil, Chile and Mexico.

Insights from Our Analyst Network

Commenting on the recent shift in monetary stances at key central banks, analysts at Scotiabank noted:

“Latam central banks are grappling with rising inflation and the need to get the timing right on unwinding extraordinarily accommodative monetary conditions. Moving too soon, too aggressively could imperil recovery. Waiting too long risks embedding temporary inflation into expectations.”

Commenting on the economic outlook for heavyweight Brazil in H2, analysts at the EIU noted:

“The growth rate in 2021 overall will be mostly due to strong statistical carryover effects (3.6%) from 2020, as sequential growth will be curbed by rising interest rates and inflation, and a slow vaccine rollout. Our expectation of a gradual pickup during the second half of the year assumes that potential further major waves of coronavirus cases and mobility restrictions have less of an impact on activity as economic actors adapt and the vaccine rollout advances. Another risk to our forecast later this year is the impact of droughts on electricity production, which could lead to power rationing, outages and tariff hikes.”

Our Latest Analysis

Pedro Castillo was sworn in as president of Peru on 28 July. Our economist Stephen Vogado breaks down what this means for the economic and political landscape.

Central bank interest in cryptocurrencies is rising. In our latest insight piece, we examine the current state of central bank digital currencies (CBDCs) and what they could mean for the economy.