Milei’s omnibus bill finally passed

In mid-June, Argentina’s Senate narrowly approved President Javier Milei’s omnibus bill, a package of measures designed to breathe life into the moribund economy. Milei’s omnibus bill includes fiscal incentives to lure foreign investment, the privatization of some state-owned companies, the delegation of emergency powers to the president, and a tax amnesty to encourage citizens to declare assets. The package has been heavily watered down in recent months; the initial bill rejected by Congress in February aimed to privatize over 40 companies, for instance, whereas in the final text approved in June that number was reduced to just two. But it still marks the first real legislative win for a president who until now has governed largely via executive orders.

The economy is in a deep hole

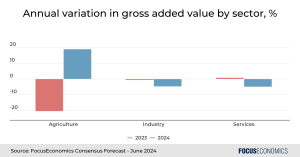

President Milei’s decision late last year to devalue the currency, lift subsidies and slash public spending has provoked a deep recession. Construction and manufacturing output fell 30% and 20% respectively in Q1, with agriculture—which is recovering from last year’s extreme drought—the economy’s sole saving grace. Our panelists have downgraded their 2024 forecasts as a result, and now see a 3.3% year-on-year contraction in 2024 as a whole, down from 2.0% at the outset of the year.

The government is seeking more much-needed reforms

While the passage of Milei’s omnibus bill in the Senate should support business confidence and investment ahead, our panelists’ current projections suggest that the economy would only return to its 2018 size by 2027—hardly a stellar performance. This suggests that more reforms may be required. One area that the government is focusing on is the exchange rate regime; investing in Argentina is an unenticing proposition as the country has strict capital controls and multiple exchange rates that are prone to large swings in value. The government hopes to lift these capital controls and to allow the U.S. dollar to compete freely with the peso once it has cleared the Central Bank’s balance sheet and secured fresh IMF funding—something which could happen later this year. And further ahead, Milei still appears to have his sights firmly set on the full dollarization of Argentina, though it is unclear whether he will have the requisite foreign currency reserves and political support to make it happen. The Senate victory represents one battle in Milei’s quest to turn around the economy. But the war is still to be won.

Insight from our analyst network

Itaú Unibanco analysts commented:

“Confidence in the administration remains elevated according to the Universidad Torcuato di Tella’s index (50% in May from 57% in December 2023), despite high inflation and falling activity, and provides the administration more bargaining power with Congress and provinces. All in all, the bill’s approval should mark a turning point in President Milei’s ambitious deregulation agenda, triggering an improvement in investment and a further improvement in our fiscal projections (primary budget surplus of 0.5% of GDP in 2024).”

On the next legislative step for the government’s reform package, EIU analysts said:

“Both bills [the omnibus and fiscal reform bills] will now return to the Chamber of Deputies. […] We attach a 70% probability to the scenario whereby the lower house rejects the changes [made by the Senate, including those] that would reduce the government’s tax take. As a result, we expect the government to gain the revenue that it needs to avoid greater spending cuts and to provide the provinces with greater revenue, as income taxes are shared.”

Our latest analysis

Mexico’s peso slumped after the MORENA party won recent elections. What’s in store next for the currency?

Hungary’s economy improved in Q1.