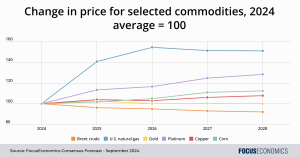

Most energy prices to fall in coming years: Our analysts expect prices for crude oil and coal to decline over our forecast horizon to 2028, driven by a global shift to cleaner forms of energy for vehicles and power generation. In contrast, natural gas prices are set to rise from 2024 levels, as gas demand is likely to continue rising in the coming years; the fuel will be increasingly used by emerging markets as a less-polluting substitute for coal-fired plants.

Precious metal prices to mostly stay historically high: Our Consensus is for gold prices to stay above USD 2000 per troy ounce and for silver prices to remain higher than USD 25 per troy ounce—both price points are well above the levels that have prevailed in past decades. Gold will continue to be valued as a safe haven in an increasingly uncertain world, while silver will benefit from rising demand from the solar and electric car industries; in 2024 alone, photovoltaics demand is set to rise by a fifth. Plus, platinum demand will increase in coming years on the back of the metal’s usage in the nascent hydrogen economy in both fuel cells and electrolysers.

Agricultural prices to be broadly steady on the whole: Most agricultural prices are not projected to experience notable upward or downward trends in the coming years, though within-year volatility is highly likely in response to extreme weather events and conflict. One such weather pattern is La Niña, which could replace the El Niño phenomenon later this year or in early 2025. La Niña would push warm water toward Asia and cold water toward the west coast of the Americas, which would likely boost rainfall in some areas of Asia and the Americas and reduce it in others.

Base metals to see stable trend: Panelists also see stable price dynamics in most base metals. While demand for some metals—such as copper, cobalt and aluminum—will be boosted by expansions in the wind and solar sectors and the electrification of transport and industry, the positive impact on prices will be largely offset by stronger supply and slowing global GDP growth. Increasing resource nationalism is a key factor to watch: In recent years for instance, China has banned rare earth metal exports and Indonesia has restricted overseas sales of nickel in a bid to develop a domestic processing industry.

Insight from our analysts:

On the gas outlook, EIU analysts commented:

“We believe that the disruptions in global gas markets as a result of the war in Ukraine have resulted in a lower demand outlook for the first half of this decade. However, we expect a stable growth outlook in the second half of this decade primarily led by developing countries, many of whom will raise their gas consumption to replace coal.”

On the near-term copper outlook, Goldman Sachs analysts said:

“In copper we’ve observed significant price elasticity of both supply and demand this summer. As a result, the sharp copper inventory depletion we had expected will likely come much later than we previously thought. Accordingly, we delay our end-2024 copper target of $12,000/t to post-2025, implying a 2025 copper forecast of $10,100/t, still above this YTD’s $9231/t, but well below our previous $15,000 expectation.”

Our latest analysis

Canada’s central bank cut rates again in September as inflation remained under control.

The euro area’s services sector was solid midway through Q3.

One of the exciting updates for our 25th anniversary is that our newsletter will now be sent biweekly. It will feature more detailed articles and deeper analyses of the international macroeconomic landscape, offering valuable insights to help you stay informed on global trends. Stay alert for more news in the upcoming weeks!