In early December, South Korea’s president Yoon Suk Yeol made a short-lived declaration of martial law, only to quickly rectify when Parliament voted against it. He was then subject to impeachment proceedings: Despite surviving the vote thanks to support from his party, pressure on the President is growing, and snap presidential elections are a possibility in 2025. Below is a look at the economic implications and our Consensus Forecasts.

The domestic economy could take a short-term knock

Private consumption and fixed investment could be dampened by more pessimistic consumer and business sentiment, given that political uncertainty is likely to linger for some time. Both indicators have been subdued so far in 2024: High interest rates have weighed on private spending, and the government’s fairly austere fiscal stance has contained government spending.

Exports to be unaffected

Exports have been the key growth driver throughout 2024, rising around 8% in annual terms in Q1 through Q3 thanks to surging semiconductor shipments. Given that martial rule was quickly rescinded, there should be no disruption to the export sector, which should continue to grow faster than total GDP as rising global AI usage spurs demand for the country’s electronics.

Monetary easing could accelerate

The Bank of Korea has cut interest rates by 50 basis points so far this year, and has pledged to inject unlimited liquidity to stabilize markets following the martial-law declaration. If domestic demand is negatively impacted by political instability, this could cause the Bank to accelerate its easing cycle. As of now, most of our panelists see 50 basis points more of cuts in 2025.

2025 snap elections could herald an opposition victory

If the President resigns, this could spur snap presidential elections next year. Given public dissatisfaction with the President, this would likely result in a victory for the opposition party, which already controls Parliament. As such, policymaking—which is currently gridlocked—would become easier, and fiscal policy would likely become more expansive.

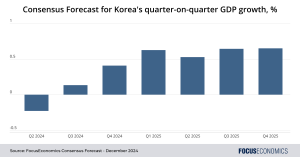

Our panelists’ current outlook for South Korea

Our Consensus is currently for South Korea’s economy to slow next year as the U.S. raises import tariffs, but domestic politics adds an extra degree of uncertainty: A prolonged political standoff between Parliament and the President or a reimposition of martial law could weigh on growth, but swift snap elections could be growth-positive if the opposition party emerges victorious.

Insight from our analysts

On the political outlook, EIU analysts commented:

“We currently estimate that a presidential election will take place late in the first half of 2025. We expect the election to produce a new president from the opposition Minjoo party. Although our base case is that recent events will be negative for South Korea’s economic outlook, there are in fact risks to the upside as well. A president from Minjoo would unify the executive and legislature, precluding another two years of political sclerosis until a 2027 election. Minjoo is also historically more fiscally liberal, which could result in higher government spending.”

On the economy, Nomura analysts said:

“We expect high political uncertainty to weigh on already weak consumption and construction investment. Amid slowing export growth, a prolonged period of uncertainty would increase the downside risk to our below-consensus 2025 GDP growth forecast of 1.7% y-o-y (BOK: 1.9%).”

Our latest analysis

- The Canadian economy only managed a slight expansion in Q3.

- New Zealand’s central bank cut rates recently due to a sluggish economy.