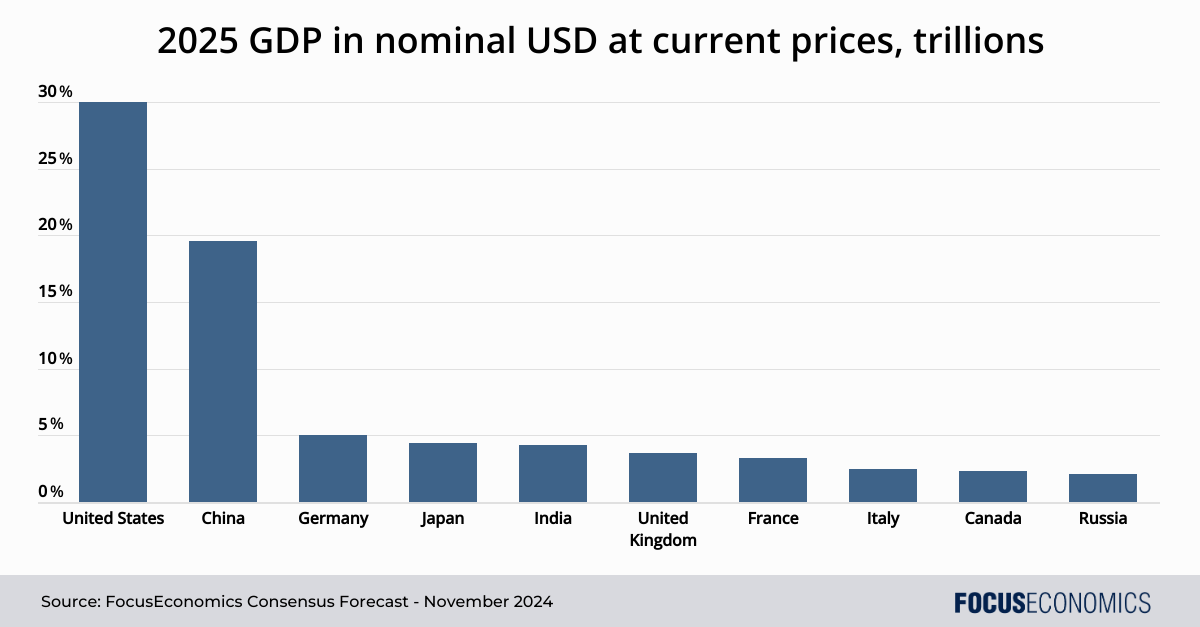

Overview of the Biggest Global Economies

Of the top 10 largest economies next year, five will be in Europe, three in Asia and two in the Americas. Most of these economies—concretely the G7 members—are already wealthy in USD GDP per capita terms. However, there are also a few emerging markets on the list that are still poor in per-person terms and whose large economic size is linked instead to their huge domestic populations. Likewise, while most of the economies in the top 10 have potential growth rates below the global average due to already high physical and human capital stocks, two of the Asian economies listed buck that trend.

Top 5 Economies in the World

1. United States

2025 GDP: USD 30.4 trillion

The United States’ GDP is the world’s largest, being worth over a quarter of global output in nominal GDP terms. Moreover, it has among the world’s highest GDP per capita. The economy’s structure is highly diversified. The tech industry, anchored by Silicon Valley, dominates globally, driving innovation in AI, biotech and software. The financial sector, centered in New York, boasts the world’s deepest capital markets. Healthcare and pharmaceuticals are other strengths, while manufacturing—though reduced in scale compared to previous decades—remains competitive in areas such as aerospace, defense and motor vehicles.

Since the Covid-19 pandemic, the gap between the U.S. and other major advanced economies has widened due to a strong dollar and the U.S.’ persistent economic outperformance. This outperformance is set to continue going forward: Our Consensus Forecast is for economic growth of around 2% per year for the rest of this decade, compared to 1.4% for the Euro area and less than 1% in Japan.

That said, the economy faces challenges, including the highest income inequality in the G7, aging infrastructure, high healthcare costs and mounting national debt. Regarding the latter, the U.S. will likely continue to run a budget deficit far wider than other advanced economies, causing public debt to continue to rise as a share of total output in the coming years.

2. China

2025 GDP: USD 19.6 trillion

China’s GDP is the world’s second largest, being worth close to 20% of global GDP in nominal USD. It is powered by investment and export-led manufacturing; private consumption is still around 20 percentage points of GDP lower than in developed economies. Known as the “world’s factory,” China is the leading producer of electronics, machinery and textiles. The government has recently prioritized technological self-reliance and increased value-added activities, showering domestic industries with subsidies and state support and restricting the participation of foreign firms in sensitive areas of the economy. This has led to some impressive results, including the emergence of highly competitive local juggernauts such as Huawei and Tencent in the tech space and BYD in electric vehicles. In recent years, such firms have increasingly broken into overseas markets, causing alarm in the West. Government support has also helped make China’s economy a leader in the green space: Chinese firms produce the majority of the world’s solar panels for instance.

Relative to the U.S. economy, China has lost pace since 2021 due to the depreciation of the yuan versus the dollar coupled with robust economic activity in the U.S. Our analysts’ estimates are for convergence to resume over our forecast horizon, but at a slower pace than in the past as China’s potential growth ebbs.

China faces multiple challenges, including high levels of corporate debt, dealing with the demands of a declining and aging population, a weak property market, and geopolitical tensions with the West—with the latter set to rise under President Trump’s second term.

3. Germany

2025 GDP: USD 5.0 trillion

Germany is Europe’s largest economy. Though services is the main economic sector, Germany also has a strong industrial base; the manufacturing sector is around twice as big as that of other G7 economies as a share of GDP. The Mittelstand—a dense web of medium-sized industrial enterprises—forms the backbone of this. The country benefits from a skilled workforce, prudent fiscal management and a favorable geographical position at the heart of Europe.

That said, the country’s export-oriented, manufacturing-heavy economic model has come under threat in recent years from rising global trade tensions, the country’s struggle to adapt to new forms of technology, and the increasing competitiveness of Chinese firms—particularly in the automotive space. Volkswagen’s announcement in 2024 that it intended to close several factories is indicative of the latter. An aging population, dependence on imported fossil fuels and political fragmentation amid the rise of the right-wing AfD party are additional challenges. Since 2018, Germany’s GDP growth has lagged well below the G7 average, a trend which will likely continue in the coming years

4. Japan

2025 GDP: USD 4.4 trillion

Japan’s economy, while still the fourth largest in the world, has waned in relevance since the 1990s, at which point it was the second-largest economy and closing in on the U.S. in top spot. Like Germany, Japan has a large manufacturing sector worth close to 20% of GDP, with strengths in electronics, motor vehicles and robotics; Japanese companies like Mitsubishi, Sony and Toyota play leading roles globally. Japan also has a significant banking and financial services sector. The economy is export-oriented, and has persistently registered trade and current account surpluses in recent years.

However, Japan faces significant demographic challenges, including a rapidly aging population and low birth rates that drag on GDP despite persistent fiscal stimulus. Dependence on imported energy and raw materials is another weakness, as they make the economy vulnerable to global price shifts. Our panelists forecast Japan’s GDP growth to average below 1% for the remainder of this decade, and to record the joint-weakest performance in the G7 along with Italy.

5. India

2025 GDP: USD 4.3 trillion

India’s GDP is growing fast, having more than doubled in size over the last decade. Unlike many other Asian economies, India does not have a huge manufacturing sector, notwithstanding the government’s recent Make In India initiative. Rather, services output drives GDP. India boasts particular strength in IT; collectively, the country’s two IT giants, Infosys and TCS, employ around a million people. The pharmaceutical industry is another strong suit, especially in the field of generic drugs. However, the agricultural sector, which employs a large portion of the population and still accounts for around a fifth of the economy, remains less productive and vulnerable to climate risks.

India’s economy has a number of strengths, including a fast-growing and entrepreneurial population, a highly educated English-speaking workforce, a vast domestic market and political stability. That said, infrastructure gaps—particularly in rural areas—are a roadblock. Additionally, regulatory challenges and bureaucratic hurdles pose difficulties for businesses, and the country is still not able to guarantee quality universal education.

Our Consensus is for the economy to remain among Asia’s fastest-growing in the coming years, but growth could be significantly faster with the right reforms; at below 7% per year, India’s growth forecasts for the coming years are still significantly below the pace that China was growing at when it had a similar GDP per capita.

Economies 6-10

6. United Kingdom

2025 GDP: USD 3.7 trillion

The UK economy is predominantly service-oriented, with insurance, finance and real estate as key contributors—particularly through the City of London, a major global financial hub. Other key sectors include creative industries, defense, higher education, motor vehicles and pharmaceuticals. A flexible labor market and well-performing education system are key strengths.

However, Brexit has introduced challenges, particularly for trade and labor mobility with the EU: This, in turn, has hampered exports and investment since the UK left the bloc. While the UK could strike some sector-by-sector deals with the EU in the coming years, economic ties with the bloc are unlikely to grow substantially closer. Additionally, the authorities face the difficulty of satisfying rising public spending demands in a low GDP growth environment, all without spooking markets by issuing lots of new debt. The Labour government that took office in 2024 has increased spending and taxes in a bid to tackle this situation.

Our analysts’ forecasts for the coming years are for UK GDP growth to be around half a percentage point per year lower than in the decade leading up to the Covid-19 pandemic, due to the lasting knock caused by Brexit.

7. France

2025 GDP: USD 3.3 trillion

France’s economy is highly diversified. The country is a leading global exporter of luxury brands like Chanel, Hermès and LVMH. Aerospace, led by Airbus, is also a crucial sector. France’s agricultural sector is the largest in the EU, and is known for dairy, grain and wine production. Moreover, since Brexit, Paris has increased its status as a financial center; the European Banking Authority relocated to Paris, and the capital has created thousands of new financial-service jobs.

The state has a strong role in the economy. Government spending is close to 60% of GDP, much higher than in most European neighbors. Moreover, the state owns shares in many large companies, such as nuclear power producer EDF, airplane manufacturer Airbus, and car maker Renault. This sizable state footprint has in recent years translated into some of the widest fiscal deficits in the EU, in turn causing French borrowing costs to exceed those of Greece and Spain.

France’s GDP growth in the coming years will be higher than that of Germany and Italy but merely average by EU standards. Political instability and the need to rein in the fiscal deficit will act as a drag, while frequent public protests will likely continue to pose a challenge to policymakers.

8. Italy

2025 GDP: USD 2.5 trillion

Italy’s GDP is dominated by services, but also has manufacturing strengths in luxury goods, machinery and motor vehicles. Northern Italy, home to industrial hubs like Milan and brands like Fiat and Ferrari, drives much of this manufacturing activity. Italy is also Europe’s third-largest agricultural producer, famous for wine and olive oil.

In recent decades, political instability, a high public debt-to-GDP ratio, a sclerotic public sector, deteriorating demographics and large regional disparities between the industrialized north and underdeveloped south have posed challenges. Though the economy is currently receiving a sizable boost from the disbursement of EU recovery funds, annual GDP growth is unlikely to top 1% this year or in the years that follow. As such, Italy’s economic cleft will continue to ebb going forward.

9. Canada

2025 GDP: USD 2.3 trillion

Canada’s economy is resource-rich, with oil, forestry and mining making an important contribution to exports. That said, Canada’s GDP as a whole is still dominated by the services sector, with financial and tech services particular strengths. In recent years economic activity has been buoyed by strong demand in key trading partner the U.S., as well as by a rapid rise in the population—from 2019 to 2024 the population rose around 10%, above the historical trend. That said, the government recently cut immigration quotas in the face of rising unemployment and public dissatisfaction over high housing costs. As a result, population growth in 2025 should almost grind to a halt from around 3% in 2024.

Despite its large natural resources, skilled workforce and clean governance, Canada also faces vulnerabilities, including fluctuating prices for its commodity exports, high household debt and trade dependency on the U.S. The latter could be a particular risk due to President Donald Trump likely imposing higher tariffs on imports.

10. Russia

2025 GDP USD 2.1 trillion

Russia’s economy depends on natural resources, with oil and natural gas making up over half of its export revenues and state-controlled giants like Gazprom and Rosneft dominating energy production. This energy reliance has spurred significant economic growth but also makes Russia vulnerable to global price fluctuations and energy sanctions. The manufacturing sector is centered on heavy industries, including arms, chemicals and steel; moreover, Russia is one of the world’s largest grain exporters. Since the invasion of Ukraine in 2022, Russia’s economy has become more dependent on the military sector and government spending, and more reliant on Asia at the expense of Europe.

The economy has been much more robust than more analysts expected since the Ukraine war broke out, with Russia’s GDP growth above 3% in 2023 and 2024, thanks to higher military spending, social handouts and the government’s ability to circumvent sanctions. That said, growth will slow to around 1.5% going forward according to our panelists’ estimates, amid a weak business environment and a declining population.

Factors Influencing GDP Rankings in 2025

A nation’s economy is the combination of its output per person multiplied by the population size. As such, countries with large populations (such as China and India) tend to have higher total GDP than those with smaller populations, even if they are less wealthy in per capita terms. Moreover, output per person is determined by myriad factors, such as the quality of health and education, physical infrastructure, ease of doing business, corruption, natural resource endowment, etc.

Future Projections for the World’s Biggest Economies

The list of the top 10 largest economies in the world is likely to grow more diverse in the coming decades. The number of G7 economies featured will decline, while emerging markets such as Brazil, Indonesia and Mexico could join the top tier given their large populations and ample potential for catch-up growth with the West. Moreover, China and India will continue to gain relative economic clout. For instance, the long-term projections of the economists that we poll show that by 2033, India will have become the world’s third-largest economy, while China’s GDP will be around USD 24 trillion larger than Germany’s, compared to around USD 14 trillion bigger today.

Insight from our expert analysts

Analysts at the EIU said:

“EIU forecasts that the US economy will grow by an annual average of 2% in real terms between 2024 and 2050. This is significantly slower than the 3.4% achieved during the 1980s and 1990s, but is still a respectable rate of expansion for a mature OECD economy, particularly as population growth will slow compared with previous decades. The US benefits from several advantages that will support its long-term growth prospects. The regulatory burden is low, helping to create conditions in which firms are free to invest and innovate. Labour laws are unusually light, meaning that firms can hire and fire workers with ease as business conditions change. The US is a world leader in the development of information and communications technology (ICT), which it has used to reap significant efficiency gains. We expect further improvements in the use of ICT, particularly as the US-China rivalry adds further impetus to domestic technological innovation.”

Analysts at DBS commented:

“China’s economy is expected to grow around 5% in 2025 supported by policy stimulus. Exports will be a key pillar of growth as global demand holds up, though new US tariffs could shave up to 1ppt off GDP growth. Consumption will remain lackluster due to wealth effects from falling property prices and rising unemployment. Infrastructure investment will drive a moderate fixed asset investment recovery, though private investment lags. Downside risks center on the property market correction. Hopefully, strong stimulus measures on both demand and supply sides, including inventory destocking and developer financing support, can aid market stability. Central government’s fiscal expansion will help local government to sail through its indebtedness.”

If you enjoyed this article, why not check out our blog post on the world’s top 10 poorest economies?

Originally published in December 2017, updated in November 2024