Amid the largest strikes since 1995, we examine whether French President Macron’s pension reform is inevitable.

Since the French government unveiled its plan to raise the pension age from 62 to 64 in early January, strikes have erupted. 1.3 million people took part in the latest demonstration on 31 January—making it the largest since 1995.

The strikes could force the government to alter or even abandon its reforms. According to the government, there is an urgent need to reform the pension system to ensure the long-term sustainability of pension spending as the proportion of active workers to retired workers declines.

The reform consists first and foremost in plugging the yearly deficit between pension contributions and pension spending. After posting a surplus in 2021 and 2022, the pension system is expected to fall into a deficit from 2023 onwards. That deficit will reach EUR 13.5 billion by 2030 according to COR, the French public body in charge of monitoring the pension system. As such, between 2023 and 2030, the cumulative pension deficit would reach between EUR 60–80 billion. In response, the government’s reform would offer EUR 18 billion in annual fiscal space by 2030.

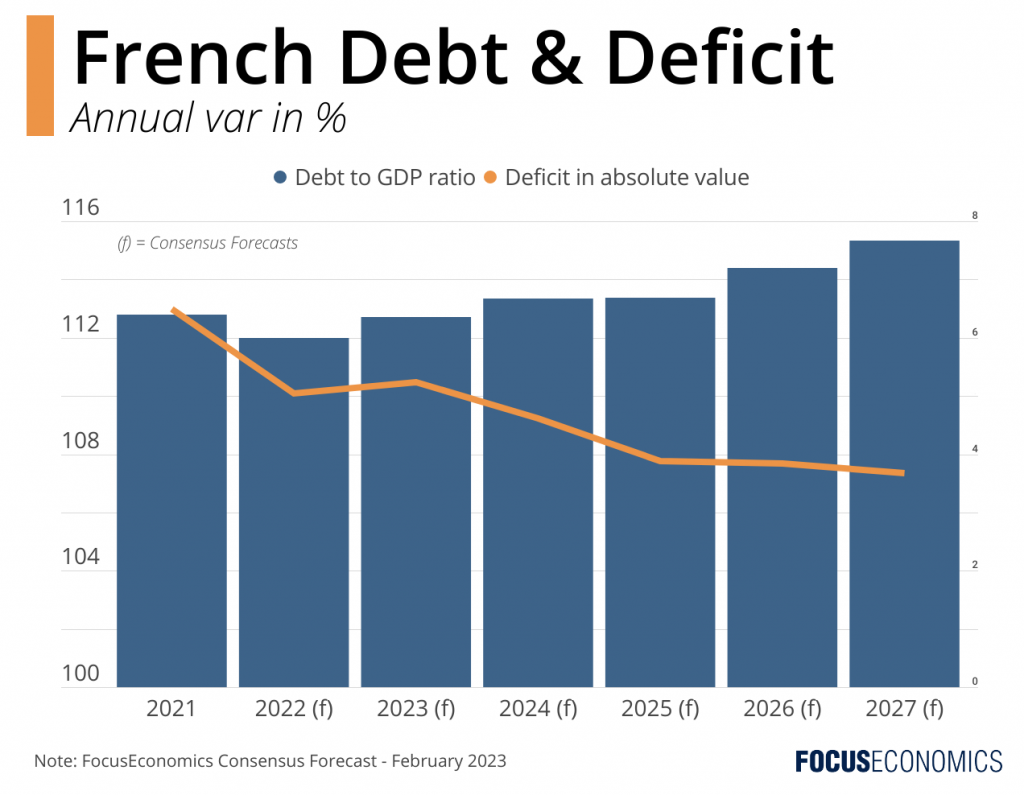

However, our Consensus Forecasts cast doubt on the necessity of the reform. For several months before the reform was announced, the Consensus from our panel of analysts was that the French fiscal deficit will gradually decline and that the debt-to-GDP ratio will oscillate between 112% and 115% throughout our forecast horizon to 2027.

Opponents argue that choosing to fill the gap is a political decision rather than a vital one; Macron hopes to keep being seen as a reformer in his second term. This argument is supported in part by our forecasts, which have consistently suggested in recent months that the fiscal deficit and debt-to-GDP ratio will not spiral out of control in the coming years. In addition, the EUR 7 to 8 billion in pension deficit refinancing costs by 2030 seems insignificant compared to the EUR 165 billion debt issued in less than two years to respond to Covid-19 and the EUR 100 billion in energy cost mitigation measures spent since the outbreak of the Russia-Ukraine war.

Insight from our Analyst Network

Thomas Gillet, associate director at Scope Ratings, commented:

“Rising interest rates and tighter expected ECB monetary policy are more important drivers of government spending in France (AA/Stable) in the coming years than pension deficits. […] Public debt-to-GDP would likely increase by about 2.5 to 3.0 percentage points by 2030, should France’s National Assembly fail to approve the reform or the government withdraw the reform in face of trade union opposition.”

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the opinion of FocusEconomics S.L.U. Views, forecasts or estimates are as of the date of the publication and are subject to change without notice. This report may provide addresses of, or contain hyperlinks to, other internet websites. FocusEconomics S.L.U. takes no responsibility for the contents of third party internet websites.

Date: February 3, 2023