The world economy has been in constant flux in recent decades, and the next ten years promise to be no different. In our latest special report, we look at three key takeaways from our long-term Consensus Forecasts for the next decade. Below is a summary of what to expect:

U.S. and Europe will continue to diverge

Our long-term Consensus Forecasts expect U.S. real GDP growth to outpace Euro area real GDP growth by an average of 0.6 percentage points per year over the next decade. As a result, the U.S. economy should be over 16 trillion dollars larger than the Euro area economy by 2034, compared to 12 trillion dollars today. Stronger demographics, a laxer regulatory environment, a more flexible labor market, a more unified capital market and leadership in emerging technologies will all be important factors helping the U.S. economy forge ahead of the European economy in the coming years.

China’s economic growth will slow sharply

China’s annual GDP growth is to slip below 3% within a decade’s time, according to our long-term Consensus Forecasts—above the rates of developed markets but a far cry from the growth seen in China in recent decades. A host of factors will be behind this slowdown. The scope for relatively easy catch-up growth is diminishing as the physical capital stock and urbanization rate rise. The population will decline at an ever-sharper pace in the coming years, weighing on private consumption and the property sector. And intensifying trade and tech restrictions from the West will hamper the export sector and investment.

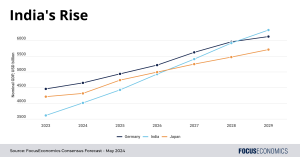

India to become the world’s third-largest economy

Our long-term Consensus Forecasts project that India will become the world’s third-largest economy in nominal GDP terms before the end of this decade, with economic growth expected to average over 5% per year. This impressive economic performance will be underpinned by multiple drivers, chiefly a population expected to grow in excess of 10 million people per year, business-friendly reforms, political stability under long-serving Prime Minister Narendra Modi, and the country’s attractiveness as a base for firms looking to divest from China. That said, China was growing at over 8% per year when it had a similar GDP per capita to India; as such, India is still not maximizing its full economic potential.

Insight from our panelists

Goldman Sachs analysts commented on India’s demographics:

“Millennials and GenZ will account for more than 50% of India’s population by 2030. This abundant labor force can help India achieve its near-term domestic growth goals while capitalizing on global supply-chain diversification opportunities. We expect India’s demographic dividend to not only unlock opportunities in services and manufacturing sectors but also unleash the spending power of the country’s young population. We expect consumption stories related to Millennials—especially in e-commerce, food delivery, and the fintech space—to be a driving force in India’s growth.”

On China’s economic outlook, Nomura analysts said:

“We do not think China’s economy has truly stabilized, as the property sector remains in decline, the risk of another fiscal cliff is on the rise, geopolitical challenges are likely to sustain, and growth might face downward pressure again over the next few months. We believe now is not the time for Beijing to be complacent, and more stimulus measures are needed to meet its economic targets.”

Our latest analysis

The UK’s GDP growth beat market expectations in Q1.

Economic activity growth in Panama slowed in February.