With the advancement of technology, automation, and artificial intelligence, the possibilities of new discoveries, inventions, and labor-saving devices seems endless. However, there are those who fear that there will be a severe cost to this newly found progress: the loss of jobs for humans. Many are concerned that as automation and artificial intelligence (AI) becomes more sophisticated and perform tasks that humans would normally do, the ranks of the unemployed will swell to dangerous levels. This could mean that the global workforce will be forced out of jobs, experience dwindling incomes, and have no opportunity or motivation to move up in the world. From factory workers to farm laborers to white-collar workers, there is a growing concern that jobs will be taken from humans and given to robots and machines thus causing massive amounts of unemployment.

In order to provide for the financial needs of unemployed and even under-employed workers, some economists and policymakers have called for a consistent stream of income without any strings attached. The premise is that all members of society would receive a steady source of income regardless of their employment status. Known as guaranteed or universal basic income, the idea is to give individuals income with the assurance that it can be used for buying food or keeping a roof over their heads and not worry about meeting requirements in order to keep the funds ongoing. But this concept, which has been debated about for decades, has its good and contentious points, and has even been tried in Canada and Finland.

What is Guaranteed Basic Income?

Guaranteed basic income (GBI) provides that everyone, regardless if they are working or unemployed, will receive a monthly income that is enough to give them a living standard that is above the poverty level. GBI would be given to every person irrespective of their particular personal economic situation. That is, regardless of their net worth or their income level on a monthly or annual basis and is not means-tested. Another key factor in GBI is that no basic requirements for receiving this income must be satisfied. This means an individual would not have to fulfill requirements such as voting, satisfy military obligations, attend school, or community service. GBI is a fixed amount that is provided by the government, must be enough for daily living requirements, and is provided regardless of race, age, gender, social level, or economic background.

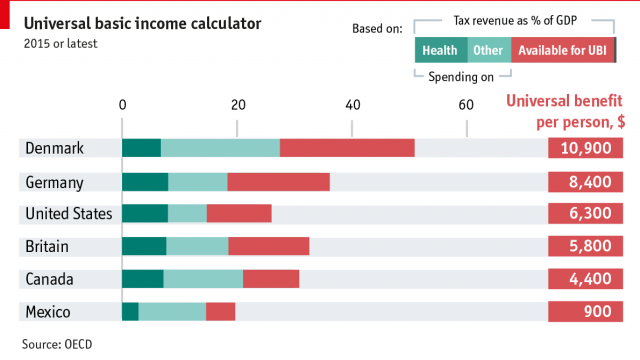

The amount to be given to each individual under GBI varies from country to country. For example, the average amount being proposed is USD 10,000 per year. However, Switzerland is considering a GBI of USD 2,600 per month but Kenya would be providing USD 1,000 annually. Finland completed a trial GBI program of EUR 560 (USD 685) provided monthly to a random sampling of 2,000 unemployed individuals. In 2017, Utrecht allocated EUR 960 (USD 1,030) to approximately 250 individuals in monthly payments from the Dutch government. There were no requirements set by the government in who should receive the funds and no stipulations in how the money should be spent. Also, in 2017, Ontario, Canada, started an experimental program in which single individuals would receive approximately USD 12,616 annually. The recipients were encouraged to keep their jobs, if employed, or even earn additional income. In the United States, a start-up accelerator known as Y Combinator commenced a GBI program in Oakland, California, in 2017. The program gives 100 families GBI ranging from USD 1,000 to USD 2,000 per month, regardless if they are employed or not.

According to the group Basic Income Earth Network (BIEN) there are five characteristics for GBI to exist:

- Payments must be made on a periodic interval, such as a monthly basis.

- Payments must be in cash in an appropriate medium of exchange.

- Funds are paid on an individual basis rather than to households.

- Funds are paid to all individuals without the use of a means test.

- There are no conditions attached to the payment of the income.

The concept of GBI is not new. Thomas Paine, one of the founding fathers of the United States and author of the treatise, “Common Sense”, devised an idea to pay 15 pounds sterling from a national fund to each adult over 21 years of age in his 1797 essay, “Agrarian Justice”. Others such as the British philosopher, Bertrand Russell, and the social credit movement in Great Britain were for GBI. During the civil rights movement in the United States in the 1960’s, Dr. Martin Luther King, Jr. was a key proponent of GBI. Dr. King wrote in his 1967 tome “Where Do We Go From Here: Chaos or Community?” that “I am now convinced that the simplest approach will prove to be the most effective – the solution to poverty is the abolish it directly by a widely discussed measure: the guaranteed income.”

Surprisingly, the conservative libertarian economist, Milton Friedman, supported GBI using a negative income tax in which it would “provide an assured minimum to all persons in need, regardless of the reasons for their need.” Friedman felt that “a negative income tax provides comprehensive reform which would do more efficiently and humanely what our present welfare system does so inefficiently and inhumanely.” Even liberal economists such as Paul Samuelson, John Kenneth Galbraith, and James Tobin advocated for the United States Congress to implement “a national system of income guarantees and supplements.” President Richard Nixon pushed for a plan in the late 1960’s calling for a partial basic income that actually passed the House of Representatives but never made it through the Senate. Nixon’s version of GBI was called The Family Assistance Plan and proposed a stipend of USD 1,600 in 1969 for a family of four who did not have earned income as well as USD 800 in food stamps. Today, GBI is being proposed due to the fear of automation and AI taking away jobs instead of just leveling out economic inequality in modern society.

Reasons for GBI

There are various reasons why GBI has been proposed, in the past and currently. First, as stated previously, there is a serious concern about the increased use of automation, robotics, and AI in replacing workers. Automation and robotics is being increasingly used in industry to perform such tasks as manufacturing blue jeans, assembling motor vehicles, flipping hamburgers, and making pizzas. In the field of services, AI is being used to read x-rays, perform banking services, and giving financial advice. The huge concern among economists and policymakers is that technology will replace humans in a substantial number of jobs before new ones can be created in order to lessen the chances of unemployment. Moshe Vardi, a computer scientist from Rice University in Houston, Texas states that “by 2045, machines will be able to do much of the work that humans do,” and he ponders as to “what will humans do?” Some analysts see the distinct possibility of a “jobless future” in which millions will either lose their jobs or experience being under-employed. The noted futurist, Martin Ford, author of “Rise of the Robots: Technology and the Threat of a Jobless Future”, states that new technologies are pushing the global economy towards “permanent technological unemployment” and increasing the need for GBI.

The use of robotics is expected to increase in the near future as the technology improves at a faster pace. For example, there are now robots that can see and hear while also understanding what they see and hear. Through AI, robots can learn in a much more scalable manner for specific domain. Robots can now manipulate objects using greater speed and strength than any human can. Robots can also perform tasks at a cheaper rate than humans since they do not need benefits, can work 24 hours a day for 7 days a week, and can be easily replaced with another robot if there is a malfunction. Where will that leave humans who are without a steady paycheck? GBI would have to take the place of that steady paycheck.

Another reason for GBI is that it can act as a buffer against systematic problems within the macroeconomy. GBI can be used to offset economic problems such as income inequality, poverty, and stagnant wage growth. While the U.S. economy is seeing low unemployment, wages are either growing at a very slow rate or are stagnant. Living standards are increasing at a precarious rate but wages are not keeping up and many households need two or more earners. Presently, it is not unusual for both husband and wife to work in order to make ends meet. Even with a low unemployment rate, many Americans do not feel confident about the future of their jobs or their financial situation, in the long or short-term. Many Americans are deeply in debt due to mortgages, auto loans, student loans, and credit cards. Job loss by one spouse could spell financial disaster for a household.

Still another reason for GBI is that it would greatly assist workers who are in dead-end or low paying jobs. For those workers who are employed by fast food restaurants, work as landscapers, or are aides in a nursing home earning minimum wage and minimal benefits, GBI could become a greatly needed financial supplement. For these individuals, working fifty to sixty hours a week is not enough to pay for their living expenses and certainly not sufficient to provide for a family. With GBI, the additional income could help bridge the wage gap such workers experience every day and at least give them some breathing room. Also, these workers are not usually members of unions and their chances of a decent wage or even benefits are non-existent. As University of Wisconsin sociology professor Erik Olin Wright stated GBI “would contribute to a greater symmetry of power between labor and capital even if workers did not engage in collective organization.”

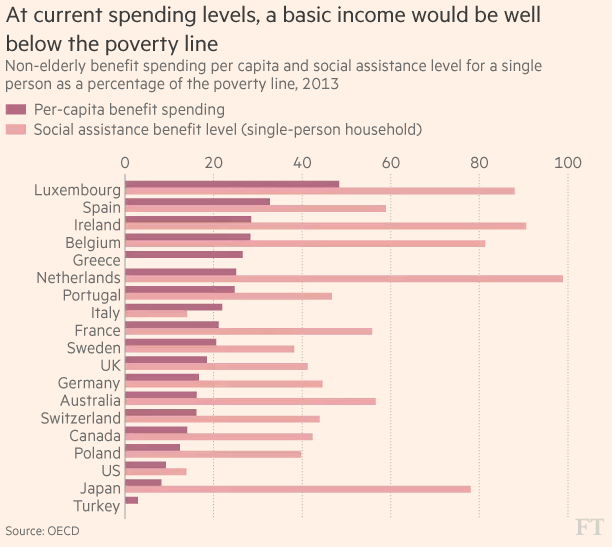

GBI could also be used to replace social welfare programs as they are presently administered. GBI would not have the paternalism of welfare programs, the requirements for benefits to continue nor the bureaucracy of such governmental organizations. Everyone in the community would be eligible and there would no longer be the stigma of governmental assistance programs. This could result in a higher degree of efficiency in government at a lower cost to administer.

Benefits of GBI

There are a number of reasons cited why GBI is beneficial in modern society:

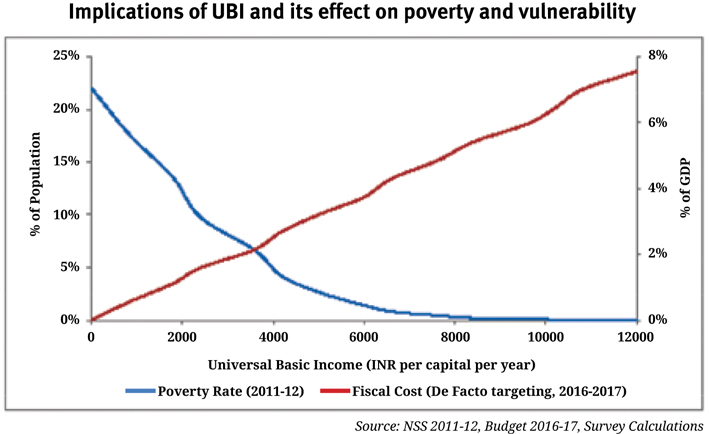

An easier way to alleviate poverty: GBI has been proposed as a simpler and most cost-effective method to reduce poverty in all countries since it would be direct cash payments as opposed to in-kind aid or dealing with conflicting rules and regulations involved in a welfare system. Michael Turner of the Cato Institute argues that the United States government allocates approximately USD 1 trillion annually on anti-poverty programs ranging from Medicaid to food stamps to the bureaucracy administering these programs. Proponents of GBI feel that in allowing every member of a society to receive cash payments, they could use the funds for such items as child care while attending classes to learn new skills or go to work without worrying about paying for baby-sitting. GBI would reduce recipient’s anxiety about paying for child care and actually allow workers to have more take home pay. GBI could also increase incentives for seeking work and marriage than the current situation facing many welfare systems. In the case of Namibia, the use of GBI reduced poverty from 76 percent to 37 percent, while raising non-subsidized incomes by 29 percent, increased education and health standards, and reduced crime by 36.5 percent.

An economic boost: By having some extra money through GBI, consumers may actually have more of an incentive to possibly spend more or pay off debts, such as mortgages or credit cards. GBI could allow consumers to have more confidence in their financial situation rather than living paycheck to paycheck. Job loss for a recipient or their spouse would not mean financial disaster but actually be an opportunity to change careers, start a new business, or go back to school to learn new skills. By having more money flowing into the macroeconomy, businesses and educational institutions would readily feel the effect of new cash inflows and thereby be able to expand their operations. The state of Alaska has an annual Permanent Fund Dividend provided by revenues from companies drilling for oil. In 2015, the fund reached a level of USD 2,072 in payments annually and, according to a study in 2010 by Professor Scott Goldsmith of the University of Alaska, it added approximately USD 900 million yearly in purchasing power to the state’s economy.

Economic shock absorber: GBI would act as an economic and financial shock absorber in times of market volatility and steep downturns in the global economy. As the economies of many nations become more interconnected, a financial disaster in one country can easily be felt in other markets. This could mean the loss of jobs or economic fortunes as more individuals and companies send products or provide services to foreign markets. GBI could act as a safety net when there is an economic downturn and help workers through job loss and income reduction.

Create a level financial playing field: Many economists are concerned that globally the rich are getting richer while the poor are growing in huge numbers. GBI could be a means to create a level playing field in terms of wealth and income redistribution. GBI would not only alleviate poverty, but also provide a means of leveling the financial distribution of income rather than more and more going to the top 1 percent. This would provide more equality of opportunity for the middle class and the poor and allow a better chance for these individuals to move up the financial ladder.

Downsides of GBI

While there are various benefits associated with GBI, the concept also has its criticisms:

Disincentive for work: Critics feel that GBI could take away a person’s reason to work and be a productive member of society. There are those who feel that individuals would have no incentive to work since an income would be provided regardless of their employment status. This could mean an eventual shortage of workers and decrease in the gross domestic product (GDP) for nations adopting GBI.

The cost to pay GBI: Some critics feel that paying for GBI would be cost prohibitive and could have more harm than good for a nation’s economy. For example, the Economist magazine projected that a nation the size of the United States would have to raise the share of GDP collected in taxes by almost 10 percent in order to give each individual, including children, an income of USD 10,000 annually. Critics charge that taxes must increase to pay for GBI and that it may actually mean a redistribution of wealth in society. These critics claim that such a redistribution would be unfair to those who took risks and succeeded in order to reach their level of success in society. According to a report by the Organization for Economic Co-operation (OECD), GBI would result in large tax increases, ineffective targeting of aid toward the poorest of society, and large numbers of winners and losers. The authors of the report, James Browne and Herwig Immervoll, state that GBI at even a meaningful level “would require tax rises as well as reductions in existing benefits and would often not be an effective tool for reducing income poverty.”

The state’s problem: Critics feel that GBI is being advanced by tech leaders and chief executive officers such as Elon Musk of Tesla and Mark Zuckerberg of Facebook since it is their companies and others like them, that are pushing the use of automation and robotics that will cost millions of people their jobs. Critics argue that tech companies will ultimately be responsible for reduction in jobs and that government should provide the displaced with GBI so that they will continue to purchase tech products and services regardless of employment status. Critics say the new world of automation and technology will come at a cost they will not pay for and that government should bear the burden. By making GBI the state’s responsibility, tech companies relieve themselves of any guilt in making exorbitant revenues and profits and reducing their number of workers through the increased use of AI and robotics.

Could GBI work?

While in theory, GBI seems like an idea that could relieve the burden of poverty and level a nation’s economy so that it is fair to all individuals, it has its possible drawbacks. As technology, automation, and artificial intelligence become prevalent in industry and society, more jobs will eventually be lost. This could result in displacing millions of people from being productive members of society to becoming unwanted burdens. Whether GBI will provide a remedy to this problem remains to be seen.

Arthur Guarino is an assistant professor in the Finance and Economics Department at Rutgers University Business School teaching courses in financial institutions and markets, corporate finance, investments, and financial statement analysis. The first half of his career was spent in the financial services industry working for corporations such as TIAA-CREF, Met Life, and The Bank of New York. He writes articles dealing with finance, economics, and public policy.

Arthur Guarino is an assistant professor in the Finance and Economics Department at Rutgers University Business School teaching courses in financial institutions and markets, corporate finance, investments, and financial statement analysis. The first half of his career was spent in the financial services industry working for corporations such as TIAA-CREF, Met Life, and The Bank of New York. He writes articles dealing with finance, economics, and public policy.

Sample Report

5-year economic forecasts on 30+ economic indicators for 127 countries & 30 commodities.