| Russia’s outsized presence

10.7 million, 573 billion, 442 million, 2,863—that is how many barrels of oil, cubic meters of natural gas, tons of coal, and tons of uranium Russia produced in 2022. As a result, Russia is the world’s third-largest energy producer after China and the United States. Russia’s importance to global energy markets led prices to spike to levels not seen in a decade after the country invaded Ukraine, with investors jittery about the impact that Western sanctions would have on Russian energy production.

Our forecasts

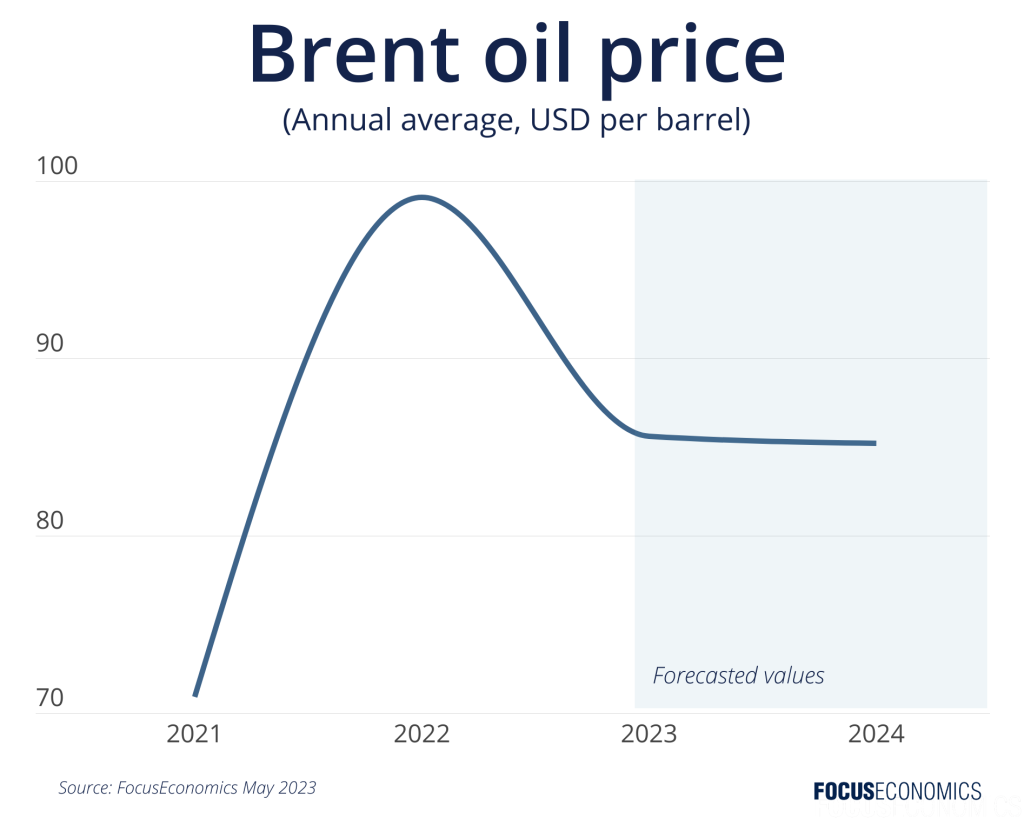

Energy prices have since retreated—but will this trend continue? In our latest special report, we included forecasts from our panel of analysts—such as Fitch Solutions, Goldman Sachs and Oxford Economics—and detailed what the main factors driving the oil, gas, coal and uranium markets will be in 2023 and 2024. Overall, in 2023, our panelists see oil, gas and uranium prices rising from current levels, while coal prices are expected to remain weak. In 2024, oil, coal and uranium prices are seen retreating. In the natural gas market, the picture is more mixed, with currently-high European natural gas prices easing and currently-low U.S. natural gas prices rising as traders take advantage of arbitrage opportunities.

Risks

That said, energy prices will remain volatile. The potential for an explosive bull run remains amid tightening supply, with panelists like Goldman Sachs expecting oil prices to reach the USD 100 per barrel threshold early next year. Much will depend on OPEC+ decision-making, the health of the Chinese and U.S. economies, and, in the natural gas market, the weather.

|

| Insights From Our Analyst Network

Goldman Sachs is bullish on the oil market:

“Our forecast remains that Brent rises to USD 95 per barrel by December and USD 100 per barrel by April 2024 as we expect large deficits in H2. While above-average DM [developing market] recession risk and our China oil demand nowcast point to downside risk, we still expect rising EM [emerging market] demand to drive 75% of the swing from the Q1 surplus to H2 deficits averaging 1.5 million barrels per day.”

Meanwhile, analysts at the EIU are more bearish:

“A global market in deficit will push oil prices towards USD 90 per barrel in the middle of 2023 and keep them at around that level for the rest of the year. These pressures, along with a recovery in the global economy, will keep a floor under oil prices of about USD 80 per barrel in 2024-25. In the longer term, permanent demand destruction in Western countries will push prices below USD 70 per barrel by end-2027.” |