The Russia-Ukraine war to continue:

In a survey we conducted in October with 100 of our panelists, 81% of respondents expected the Russia-Ukraine war to continue through next year. With both armies seemingly evenly matched on the battlefield, Putin keen to have a military victory to show for the invasion, and Ukraine still receiving aid from the West, neither side appears in the mood to back down. Continued conflict will keep grain and energy prices higher than they would otherwise be in 2024, though our Consensus is for the prices of both commodity groups to still be well below 2022 levels.

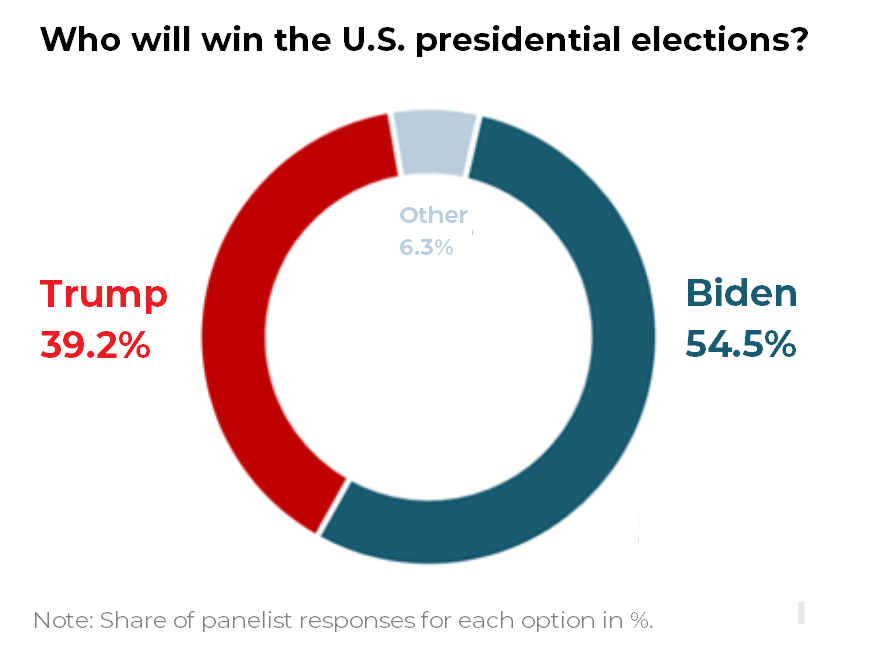

Biden to clinch U.S. presidency:

Just over half of our panelists expected Biden to win the U.S. presidential elections next year. However, he may still face a divided Congress which would stymie policymaking. 39% of respondents expect Trump to emerge victorious. A second Trump term would likely be marked by tax cuts and greater trade frictions. Moreover, the multiple criminal charges leveled against him could inflame social tensions and lead to a political crisis if he is convicted while in office.

Risks skewed to the downside:

Just over 60% of survey respondents saw risks to the 2024 economic outlook as skewed slightly to the downside, and over 70% saw risks skewed either slightly or heavily to the downside. Higher-for-longer global interest rates were by far the main downside risk cited, with over 70% of panelists selecting that option.

Regional outlook:

Our Consensus is for the Asia-Pacific and Sub-Saharan Africa regions to see the fastest GDP growth in 2024, of close to 4% year on year. Asia-Pacific will benefit from relative political stability and its position as a critical node in global manufacturing supply chains, while Sub-Saharan Africa will get a boost from population growth currently running at over 2% a year. In contrast, major advanced economies will see the slowest growth due to the lagged impact of recent rate hikes.

Commodities outlook:

During 2024, our panelists forecast base metals prices to rise, precious metals prices to stay fairly steady, and agricultural and energy prices to dip somewhat. Brent crude oil prices are projected to remain above USD 80 per barrel. The El Niño weather phenomenon, conflict in the Middle East, global interest rates and the strength of China’s economy are key risk factors.

Insight from our analysts:

On the U.S. elections, Dennis Shen, Senior Director at Scope Ratings, said:

“The historic 2024 elections in the United States look likely to be a Biden versus Trump re-match – a match-up many were hoping against. The greater uncertainty is less whether Trump is the Republican nominee and more whether there is any risk to Biden’s re-election nomination due to health reasons and internal party concerns. If it is Biden against Trump again, things are more likely this time around to go favouring Trump winning as he is no longer the incumbent – allowing him to position himself as the outsider again – and the US Electoral-College system favours the Republican candidate to a degree.”

On the Russia-Ukraine war, Goldman Sachs analysts said:

“Given upcoming US elections, financial support to the war might be fading. There is also growing disagreement among EU countries on Ukrainian financial and military support. This might shorten the war and lead to quicker peace negotiations in 2024.”

Get much more detail on the economic outlook for 2024 in our latest special report, in which we polled our panelists on the key events to watch next year. The report examines:

- The future of U.S.-China ties

- Whether the Russia-Ukraine war will end next year

- The likely outcome of the U.S. elections

- The main risks to the economic outlook next year

- Our regional, country and commodity forecasts