A week and four meetings:

The ECB, Fed, the Bank of England (BOE) and the Bank of Japan (BOJ) all met between the 13 December and 19 December. All four left rates unchanged, but there was more news: Fed Governor Jerome Powell indicated that the U.S. Central Bank was turning its focus to cutting rates, while Chairs Christine Lagarde and Andrew Bailey, of the ECB and BOE, respectively, struck more hawkish tones. Meanwhile, the BOJ remained the odd one out, with Governor Kazuo Ueda refusing to commit to raising negative interest rates in the near term.

Updated inflation forecasts:

The Fed and the ECB also slightly revised down their inflation forecasts for next year in December. However, both central banks expect inflation to remain above their 2.0% targets in 2024, before declining to around this level in 2025—in line with our panelists’ own projections.

Financial markets react:

Over the past month, the euro, pound and yen all appreciated against the dollar on expectations of more dovish Fed monetary policy ahead, and should strengthen further in 2024 according to our panelists. Meanwhile, the yield on benchmark government bonds declined significantly and stock exchanges rose in the US, Eurozone and UK.

Our panelists’ verdict:

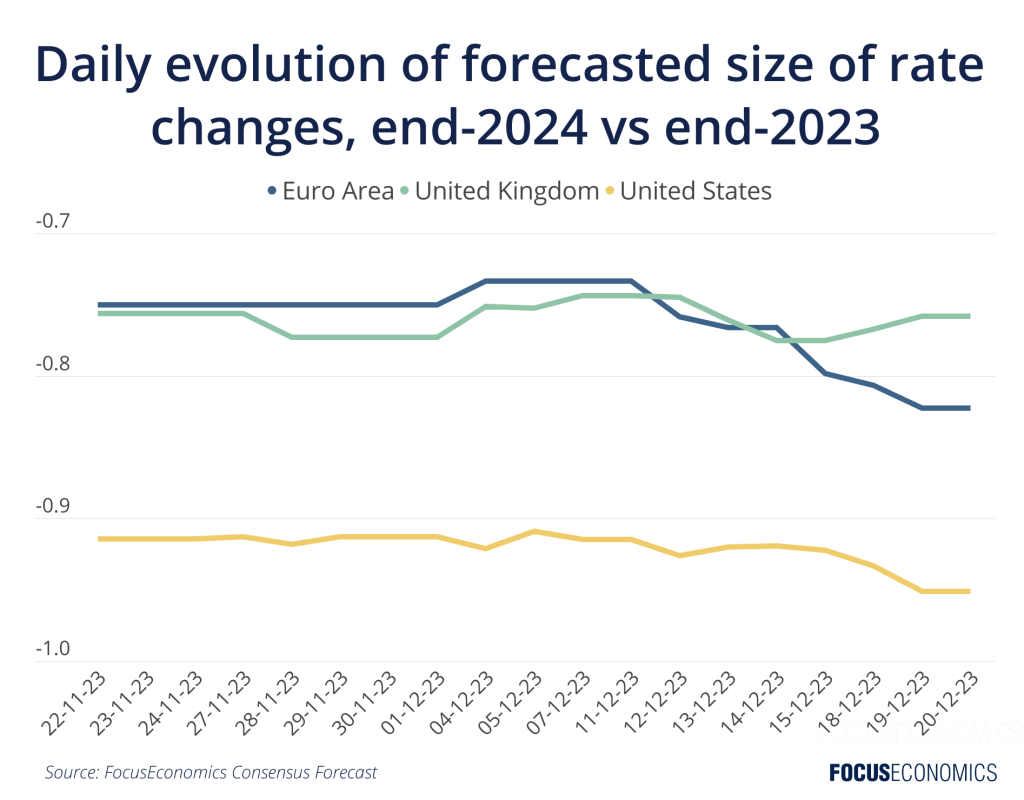

Our panelists slightly revised down their forecasts for interest rates in the Eurozone, the UK and the U.S. in the days after the four central banks met, and revised them up for Japan. This is highlighted in the chart below which showcases our daily forecasts. Over 2024 as a whole, our Consensus is for the Fed to chop rates by around 100 basis points—slightly more than the Bank’s own projections—and the ECB and BOE by 75 basis points. That said, this would still leave interest rates in the U.S. and Europe at among the highest levels since the 2008 Financial Crisis. In contrast, the BOJ is expected to hike rates by 10 basis points, taking rates back into positive territory for the first time since 2016.

Insights from our analysts

On the impact of looser developed-market monetary policy in emerging markets, Goldman Sachs’ Jan Hatzius said:

“We have shaved our policy rate forecasts for a range of other central banks, especially in EM economies where a friendlier Fed is likely to relieve pressure on exchange rates. This applies in Latin America, where we now see a lower rate profile in Mexico, Peru, and Chile, and to a lesser degree in Asia, where we have pulled forward our rate cut expectations in India, Taiwan, and Indonesia.”

On rate cuts next year, analysts at Nomura said:

“The first fed rate cut [should] not [take place] until June, which will be the start of a long cutting cycle of 100bp in 2024 and 200bp in 2025 […]. We expect the first rate cut by the ECB in June and the BOE in August, and total cuts by each of 125bp […]. [We] expect the BOJ to scrap NIRP [negative interest rates policy] in January 2024 and YCC [yield curve control] in April 2024.”