Above-trend growth:

The U.S. economy expanded a whopping 4.9% in quarter-on-quarter annualized terms in Q3. This was more than double’s Q2’s rate and well above the pre-pandemic average. It was also particularly impressive in the international context: Most G7 economies are expected to have broadly stagnated in Q3.

Consumers spend big:

Higher private consumption was the key driver, buoyed by falling inflation and a still-hot labor market—the economy created over 300,000 jobs in September, the second-largest increase so far this year. But the economy is no one-trick pony: The latest data also showed strong expansions in exports and government spending. Fixed investment—which had surged in the past two quarters as firms rushed to build factories following the passage of the CHIPS and Inflation Reduction Acts—lost steam but still expanded for the third straight quarter.

A competitive edge:

Relative to other G7 economies, the U.S. holds several key advantages which have boosted its relative economic performance recently. Huge domestic energy production—the U.S. is the world’s largest crude oil and natural gas producer—and limited exposure to Russian energy shielded the U.S. from excessive energy price spikes in the wake of the Russia-Ukraine war. Government fiscal handouts during the pandemic were extremely generous, boosting consumers’ wealth. The U.S. also boasts deep capital markets, a flexible labor market, still-healthy demographics, the world’s most dynamic private companies and the top research institutes.

The outlook:

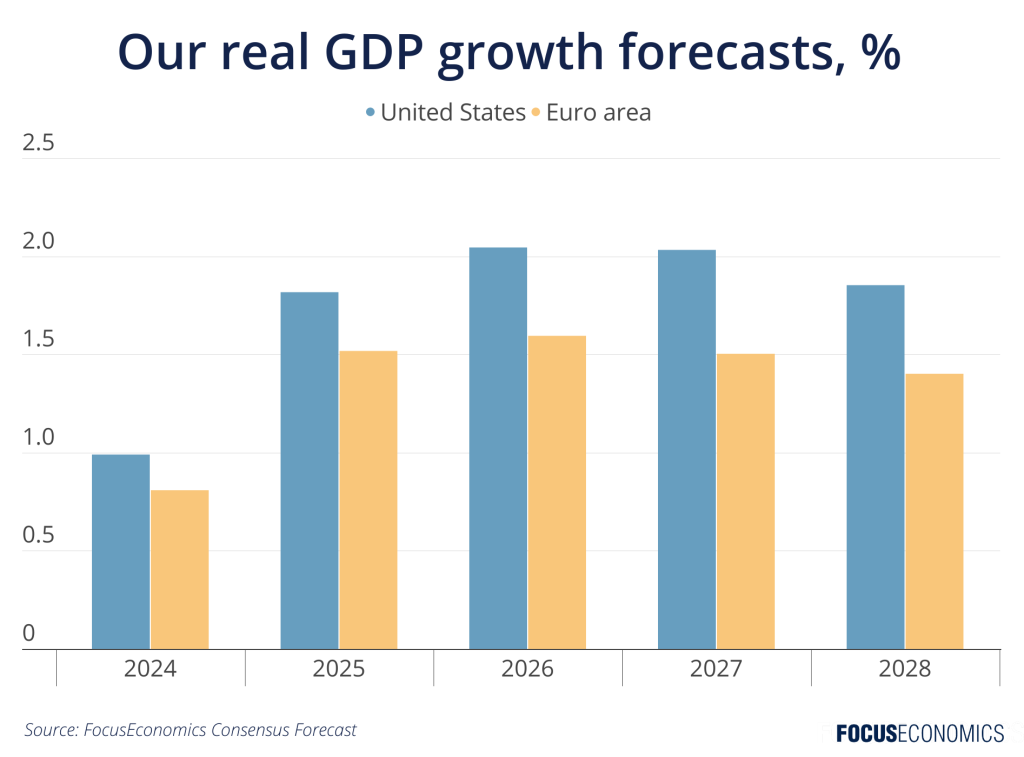

Our Consensus is for activity to slow notably in Q4, with growth of around 1% quarter-on-quarter annualized. A prolonged strike by large carmakers will be hitting manufacturing output, while the resumption of student loan payments for more than 40 million Americans in October will be taking the edge off private spending. There could also be possible government shutdown in mid-November, the point at which a stopgap funding bill expires. Subsequently, the economy is expected to see only muted growth in 2024 due to high interest rates. Looking further ahead though, GDP growth is seen averaging close to 2% per year in 2025–2028—the best performance in the G7 along with Canada. The U.S.’ structural advantages are unlikely to disappear any time soon, and relative U.S. economic outperformance will likely remain the norm.

Insight from our analysts:

On the near-term economic outlook, Nomura analysts said:

“We continue to see a material recession risk over the next few quarters, although the likelihood of our expectation of a recession starting in Q4 this year seemed to have gone down, given recent resilience of the economy.”

TD Economics’ Thomas Feltmate said:

“It’s important to not become complacent with the economy’s recent resilience. Several headwinds including the ongoing United Auto Workers strike, the resumption of student loan repayments, and the potential for a government shutdown come mid-November could lead to a considerable drag on near-term activity. This is happening at time when financial conditions have tightened significantly over the past few months and the real effective policy rate has become increasingly more restrictive alongside some easing in inflationary pressures. We expect growth to decelerate somewhere close to 1% in Q4, before slipping to a near stall speed through the first half of next year.”

Get much more detail on the economic outlook for 2024 in our latest special report, in which we polled our panelists on the key events to watch next year. The report examines:

- The future of U.S.-China ties

- Whether the Russia-Ukraine war will end next year

- The likely outcome of the U.S. elections

- The main risks to the economic outlook next year

- Our regional, country and commodity forecasts