President López Obrador won a referendum vote in mid-April allowing him to stay in office, but the political environment remains highly polarized at a time when certain economic issues, such as nationalizing the electricity industry, are key for reducing uncertainty for businesses and driving investment. Obrador has proposed a state-controlled electricity system wherein the Federal Electricity Commission would generate 54% of the country’s electricity, up from the 28% that it currently generates. Private contracts and permits for electricity generation would be cancelled in the process and the president would effectively possess direct control over the electricity industry.

Moreover, the war in Ukraine is keeping energy prices elevated. Mexico became a net oil importer in 2014 and as energy prices represent roughly 10% of the CPI basket, consumers’ wallets are bearing the costs. Meanwhile, the conflict is also introducing renewed supply chain disruptions, which are expected to hamper the country’s manufacturing sector.

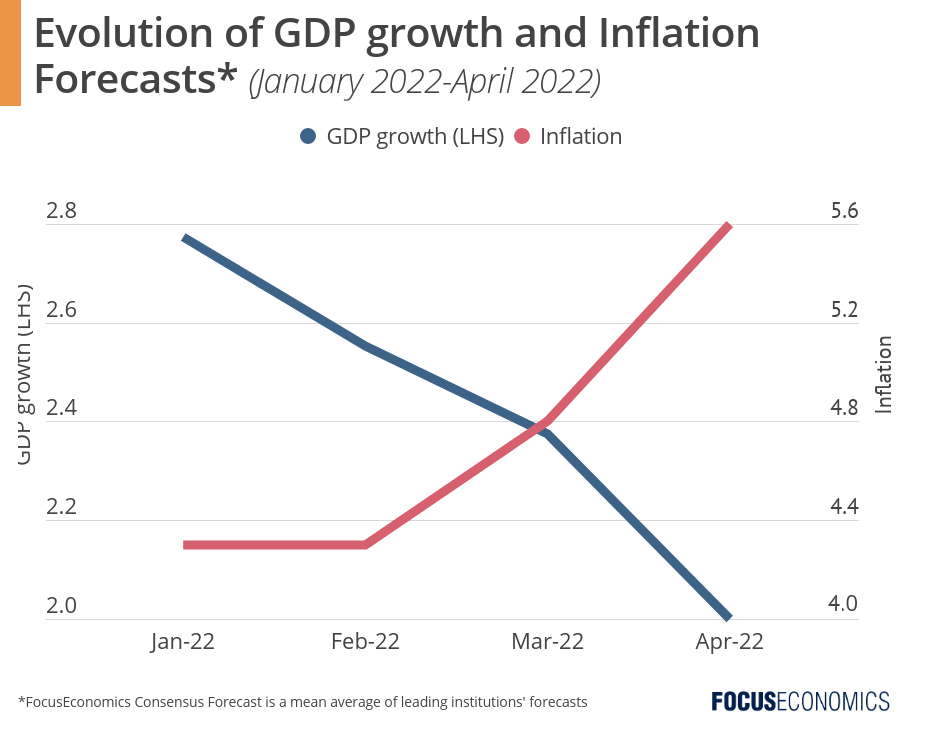

Looking ahead, a volatile political situation, tighter monetary policy and weaker growth in the U.S. are expected to keep a lid on business investment. Moreover, despite the war causing higher oil prices and supporting Mexico’s oil revenues, the hit to external demand, renewed supply chain issues and higher inflation could lead to an overall drag on output. Our panel of analysts expect Mexico’s economy to grow 2.0% in 2022, which is down 0.4 percentage points from last month’s forecast.

Insights from Our Analyst Network

Commenting on the impact of higher energy prices on the economy, José Carlos Sánchez, senior economist at HSBC, noted:

“We believe that higher oil prices could imply that the value of gasoline imports can outweigh the partial buffer of higher exports value. This could lead to relatively larger oil trade deficits, which could eventually prompt a negative impact in terms of GDP growth accounts. This, combined with other downside risks, framed a more challenging outlook for global growth, led us to recently revise our 2022 GDP forecast down to 2.0% from 2.5% recently.”

Reflecting on the outlook for and potential impact of the proposed energy legislation, Alonso Cervera, economist at Credit Suisse, noted:

“Our central scenario remains that Congress will reject the original bill and that it will introduce changes to it, the depth of which will likely depend on the PRI opposition party. Approval of an adverse reform would hurt the economy in many ways, including lower private investment in the sector, weaker public finances (via higher spending on CFE), and potential litigation in Mexico and abroad, if private contracts and trade agreements are broken.”